The longer a loan needs to be, the higher the interest rate will be to reflect the additional period of time that the creditor cannot spend their money. An inverted yield curve is where shorter term loans are yielding higher interest rates than longer term loans. This does not happen in a free market and reflects a distortion in the market.

The Second Amendment and Civil Disobedience

Civil disobedience must be tolerated by governments whose citizens or subjects are armed. It need not be tolerated if the people are disarmed.

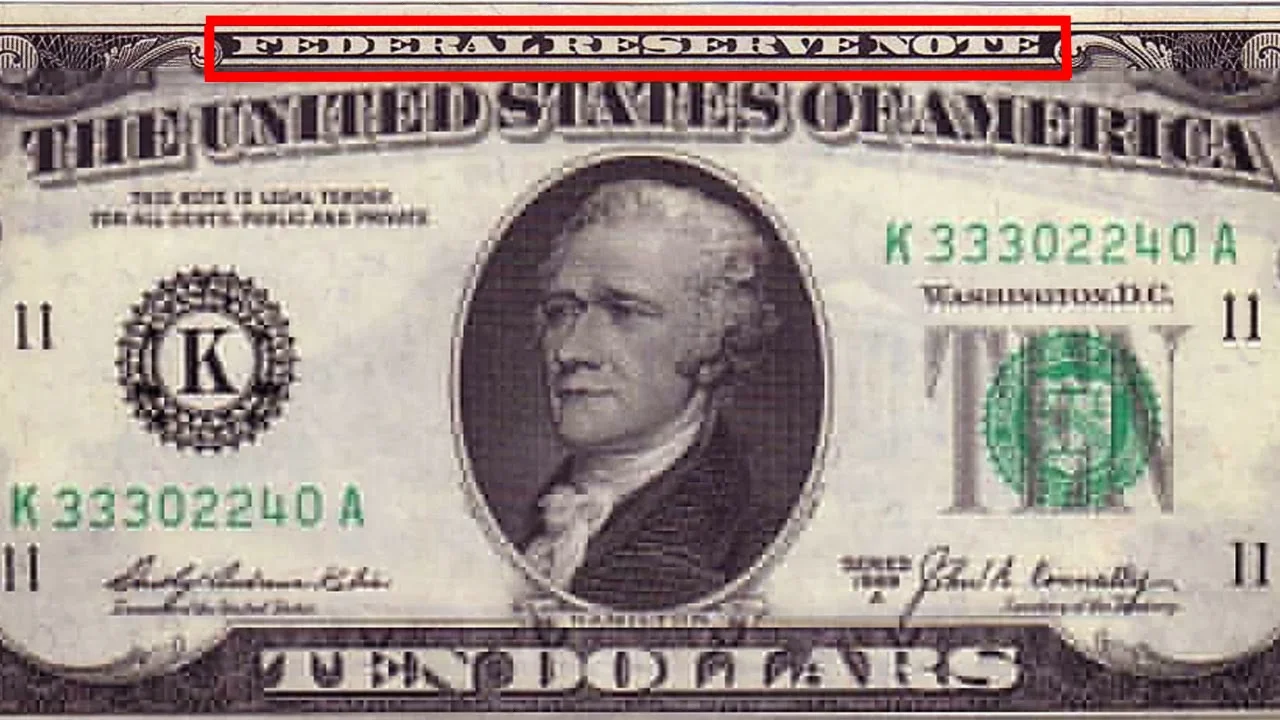

A Short History of the Dollar

The history of the dollar from the Continental, to gold and silver coin, to the Federal Reserve Note.

Freedom and Free Markets

Freedom is the basis of free markets economics.

Marxism

Communism is a stateless society where everyone produces according to ability and consumes according to need. Socialism aims to create the stateless communist society by increasing the power of the state. This is the heart of why Marxism has always failed.

Interest Rates and Inflation

How printing money decreases interest rates and the consequences

Three Opinions On Gold

Comments on the opinions of Ray Dalio, Rick Rieder, and Alan Greenspan

The Commodity Theory of Money

The origins of money as a commodity