$32 Trillion Debt

The USA have nearly $32 trillion in debt. The only way to settle the debt is by printing money or by default. The dollar is being progressively ditched as the world’s reserve currency as its purchasing powers decreases with every dollar printed. Either via inflation or default, the dollar’s days are numbered.

As a consequence of the US Congress suspending the debt ceiling to spend more money than the taxpayers have, someone needs to lend the government money.[1]

Eric Wallerstein wrote an article in the Wall Street Journal on June 7 entitled, Treasury’s $1 Trillion Debt Deluge Threatens Market Calm. He notes,[2]

“Investors are bracing for a flood of more than $1 trillion of Treasury bills in the wake of the debt-ceiling fight, potentially sparking a new bout of volatility in financial markets.”

One source of funding is the Reverse Repo Market. Per Zerohedge on twitter,[3]

“Treasury cash up $80BN since Jun 1

Rev Repo down $85BN since Jun 1

So far the TGA rebuild is funded entirely by Reverse Repo drain.”

At over $2 trillion in size, the government could find lenders from the Reverse Repo market. However, that is only if those people want to risk lending the US government money. That is because in the Reverse Repo Market, the Federal Reserve (Fed) takes on a loan in exchange for the US government bonds that they have as collateral. At the end of the day, the Fed pays back their loan with interest and gets back their US government bonds.[4][5]

The Fed does not need to engage in Reverse Repos to get a loan because the Fed can print money whenever they want. However, they have been printing $trillions for the past few years; so, they are only doing Reverse Repos to keep big banks from investing the money that the Fed had previously printed, to buy US government bonds from the banks, in the rest of the economy, thus inflating prices further (devaluing the dollar).

The Fed can fight inflating prices by raising interest rates, which reduces the amount of loans in the economy and helps lenders make up from the loss in the dollar’s purchasing power after they get paid back. However, this would make more people who need a loan unable to afford a loan.[6]

Today, the Federal Open Market Committee (FOMC) at the Fed will let us know if they are raising interest rates via the Federal Funds Rate. However, the taxpayer is unable to afford more debt, especially at higher interest rates, as the taxpayer is already spending over $600 billion this year on the interest on the debt.[7][8]

The Fed is stuck between a rock and a hard place. Either the Fed acts as the lender of last resort and the dollar becomes worth less and worthless, or it stops printing money, raises interest rates, dries up the supply of affordable loans, and causes defaults on a record scale.

Treasury Secretary, and former Chairwoman of the Federal Reserve (2014-2018), Janet Yellen said in testimony yesterday, June 13, 2023, that foreign nations were diversifying out of the dollar.

Via Filip De Mott published an article at Markets Insider, entitled Treasury Secretary Janet Yellen says to expect a gradual decline in the dollar's share of global reserves, but greenback remains dominant. He wrote,[9]

“Her comments came during a Housing Financial Services Committee in response questions about the risk of de-dollarization.

[...]

Asked whether the dollar's international status is diminishing, she noted growing diversification within reserve assets, something that can be anticipated in a growing global economy.

‘We should expect over time a gradually increased share of other assets in reserve holdings of countries — a natural desire to diversify,’ she said. But the dollar is far and away the dominant reserve asset.’"

Now, even France looks to be joining BRICS.[10]

Per the article Paris to clarify motives behind Macron’s plan to attend BRICS summit, the United News of India, published today[11]

“On Tuesday, French newspaper L’Opinion reported, citing sources in the Elysee Palace, that Macron had asked South African President Cyril Ramaphosa for an invitation to the upcoming BRICS summit. A source was cited as saying that South Africa did not say whether it was prepared to allow other international leaders beyond member states to attend the event.”

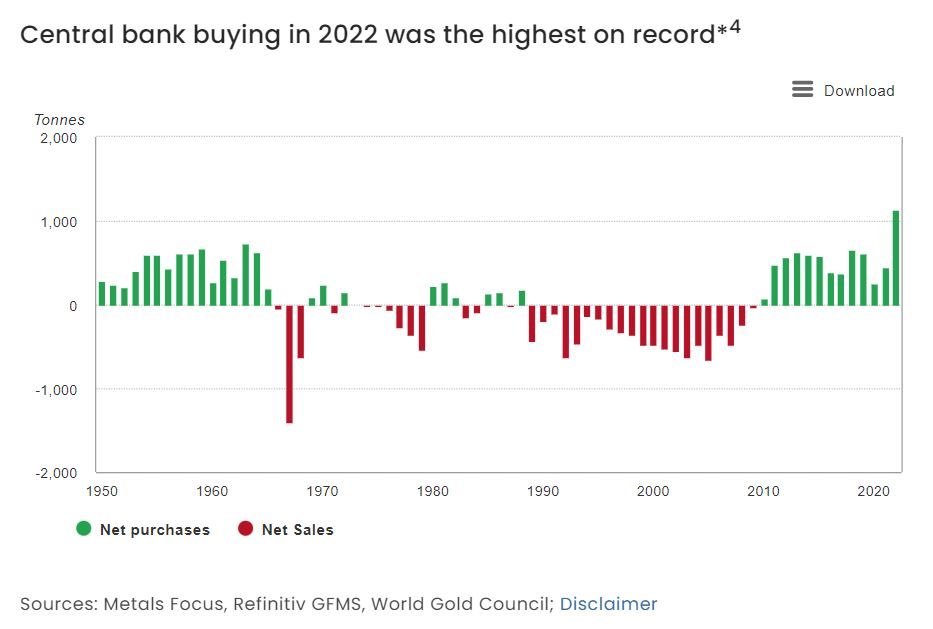

Foreign nations need a common currency to use. Central banks know what will replace the dollar.

The USA have nearly $32 trillion in debt. The only way to settle the debt is by printing money or by default.. The dollar is being progressively ditched as the world’s reserve currency as its purchasing powers decreases with every dollar printed. Either via inflation or default, the dollar’s days are numbered.

Editor’s Note: The Fed “paused” their rate hikes after a year of raising interest rates between 5% to 5.25%.

[1]https://www.theguardian.com/us-news/2023/may/31/debt-ceiling-final-vote-house-congress

[2]https://www.wsj.com/articles/treasurys-1-trillion-debt-deluge-threatens-market-calm-f2173ef4

[3]https://twitter.com/zerohedge/status/1668793316752621571

[4]https://fred.stlouisfed.org/series/RRPONTSYD

[5]https://www.hamiltonmobley.com/blog/printing-money-lowers-interest-rates

“From the perspective of the Fed, a Repo is when the Fed loans money to big banks overnight in exchange for government bonds as collateral (increasing the amount of money in the economy and lowering the repo rate).

A Reverse Repo is when the Fed uses the government bonds already in their total assets (which they had originally bought from big banks to set the Federal Funds Rate) as collateral for an overnight loan from a big bank. Reverse Repos reduce the amount of money that big banks could use to invest and inflate asset prices by instead having them loan that money to the Fed in exchange for a comparably attractive, high interest rate.”

[6]https://fred.stlouisfed.org/series/FEDFUNDS

“The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.(2)

The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity.”

[8]https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

[10]https://www.hamiltonmobley.com/blog/brics

[11]http://www.uniindia.com/news/world/summit-paris-russia-brics/2991070.html