Death of the Petro-Dollar II

Putin flew to Arabia and met with with delegations from the UAE and Saudi Arabia on Wednesday and the next day he flew back to Moscow to meet with delegations from Oman and Iran. All 5 nations are major energy producers. The petro-dollar is based on oil (energy) producing nations exclusively selling their oil for dollars. That appears to be ending.

Russian President Vladimir Putin flew to Abu Dhabi, in the United Arab Emirates (UAE) to meet Sheikh Mohammed bin Zayed al-Nahyan (MBZ) and Riyadh, Saudi Arabia to meet with crown prince Mohammed bin Salman (MBS) on Wednesday, December 6, 2023. He brought several important people with him, including the governor of the Russian Central Bank, Elvira Nabiullina.

According to Anastasia Stognei in Riga and Samer al-Atrush writing or the Financial Times,[1]

“Putin used his trip to discuss a range of issues, from energy and trade co-operation to the war in Ukraine and the Israel-Hamas conflict.

He brought a delegation of high-ranking Russian officials with him, including central bank chief Elvira Nabiullina, his top energy official Alexander Novak and Denis Manturov, Russia’s trade minister, who has a mandate to restore supply chains. Ramzan Kadyrov, the strongman leader of Chechnya, was also in attendance.”

However, this does not appear to be a normal trip. Per Guy Faulconbridge and Vladimir Soldatkin, writing in Reuters,[2]

“Mystery still surrounds Putin's trip to Riyadh and Abu Dhabi, on which he was escorted by four Russian fighter jets, and it was not immediately clear what particular issue was so important for Putin to make a rare overseas trip.”

It might have something to do with the BRICS nations attempt to replace the dollar in international trade so they can escape the financial influence of the USA.[3]

The following day, Thursday, December 7, 2023, Putin met with Oman’s crown prince Theyazin bin Haitham and Iranian President Ebrahim Raisi in Moscow.[4]

According to the Iranian Observer on twitter,[5]

“After hours of talks last night, Putin escorted Raisi to his car.

They discussed regional and international issues, mainly focusing on Gaza.

Iran’s minister of foreign affairs, minister of roads and urban development, oil minister, head of the Atomic Energy Organization of Iran, the governor of the Central Bank of Iran, and their Russian counterparts continued negotiations.”

These meetings come after Saudi Arabia and China made advancements in replacing the dollar for trade between them. Per Joe Cash, writing for Reuters,[6]

“BEIJING, Nov 20 (Reuters) - The People's Bank of China and the Saudi Central Bank recently signed a local currency swap agreement worth 50 billion yuan ($6.93 billion) or 26 billion Saudi riyals, both banks said on Monday, as bilateral relations continued to gather momentum.

Saudi Arabia, the world's top oil exporter, and China, the world's biggest energy consumer, have worked to take relations beyond hydrocarbon ties in recent years, expanding collaboration into areas such as security and technology.”

Putin also made a revealing comment on Thursday evening. According to Russia Today, he spoke about replacing the dollar in international trade at the VTB Investment Forum in Moscow.[7]

“‘According to experts, in the coming years this will lead to a real revolution that will finally undermine the monopoly of large Western banks,’ Putin said, noting that some of those financial institutions are currently ‘not in the best condition.’

The Russian president added that the interbank messaging system SWIFT has been discredited because it cut off Russian banks and is being replaced by payments in national currencies.”

Western financial dominance was based on winning WWII. It is currently based on the dollar being necessary for international trade based on an agreement between the USA and Saudi Arabia in 1974 for the Saudis and OPEC to only accept dollars in exchange for oil.[8]

Just as the petro-dollar is appears to be ending with a Middle Eastern war, it was born during the 1973 Arab-Israeli war. These nations could use a gold for oil agreement to leverage the end of the Israel-Hamas war in their favor and stop Israel killing so many Palestinian civilians. According to J.R. MacLeod, writing for Mises,[9]

“During the 1973 Arab-Israeli war, Organization of the Petroleum Exporting Countries (OPEC) had gained leverage by imposing an oil embargo, which caused serious disruptions in the global economy. In 1974 Henry Kissinger brokered a deal: Israel would back off its territorial ambitions, the Arab states would end the embargo, and oil would be traded in dollars. Thus, the petrodollar was born.”

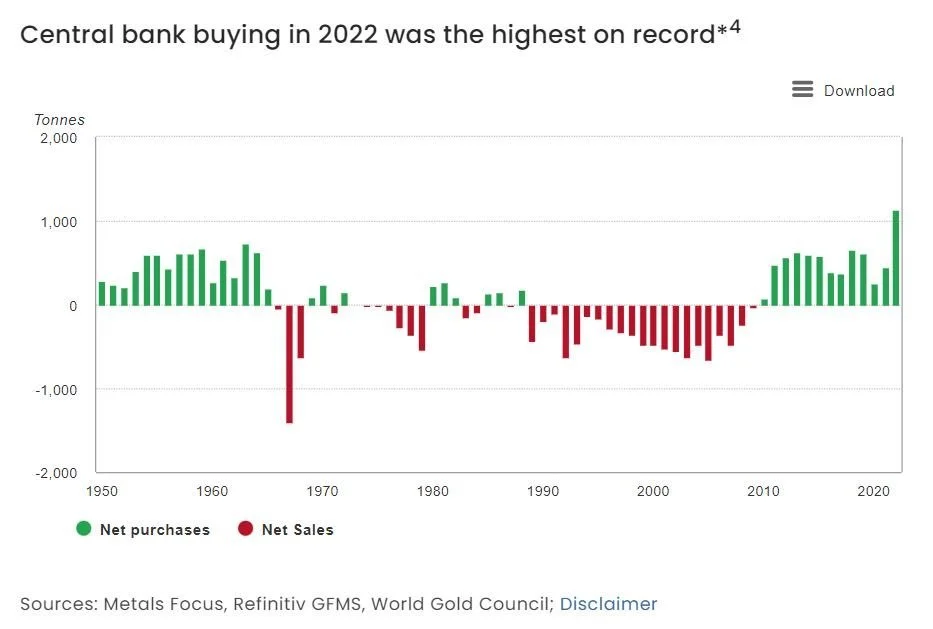

Central banks have been buying gold every year since the Great Recession of 2008, after selling their gold for the previous 20 years, for a reason. They supposedly are on pace to buy more gold in 2023 than in 2022.

Putin flew to Arabia and met with with delegations from the UAE and Saudi Arabia on Wednesday and the next day he flew back to Moscow to meet with delegations from Oman and Iran. All 5 nations are major energy producers. The petro-dollar is based on oil (energy) producing nations exclusively selling their oil for dollars. That agreement appears to be ending.

[1]https://www.ft.com/content/e2c1b3d8-4626-49fd-bcdc-5596856e9cbb

[2]https://www.reuters.com/world/russias-putin-told-saudis-mbs-we-meet-moscow-next-time-2023-12-07/

[3]https://www.hamiltonmobley.com/blog/brics

[4]https://apnews.com/article/russia-putin-iran-raisi-28fb081d30fcbd6e79662e8c1daa0159

[5]https://twitter.com/IranObserver0/status/1733085827398291923

[7]https://www.rt.com/business/588678-western-banks-dominance-end/

[8]https://www.hamiltonmobley.com/blog/r9tu385c22azkxuycdia7o3kludljh

[9]https://mises.org/wire/saudi-arabias-quandary-end-petrodollar