Depressing News

As of February 15, 2024, Germany, Japan, and the United Kingdom were in a recession. Jamie Dimon is selling shares of JP Morgan and Berkshire Hathaway is holding cash. Druckenmiller is buying gold mines. The stock price of New York Community Bank fell 60% in the first week of February. They bailed out Signature Bank. With the Bank Term Fuding Program allegedly expiring in March, are we about to be in American recession?

Germany, Japan, and the United Kingdom are in a recession. Per Bloomberg, Japan and the UK went into recession at the end of 2023.[1][2]

Jamie Dimon, the CEO of JP Morgan, is selling shares of his bank. He sold $150 million worth. This is the first time that he has ever sold stock in JP Morgan Chase since becoming CEO in 2005. [3][4]

Berkshire Hathaway, owned by the well respected investor Warren Buffett, has the most cash that it has ever had, meaning that they aren’t buying stocks and bonds like they used to do.[5]

He is often quoted by investors. One time Mr. Buffett said,[6]

"The first rule of an investment is don't lose (money). And the second rule of an investment is don't forget the first rule. And that's all the rules there are."

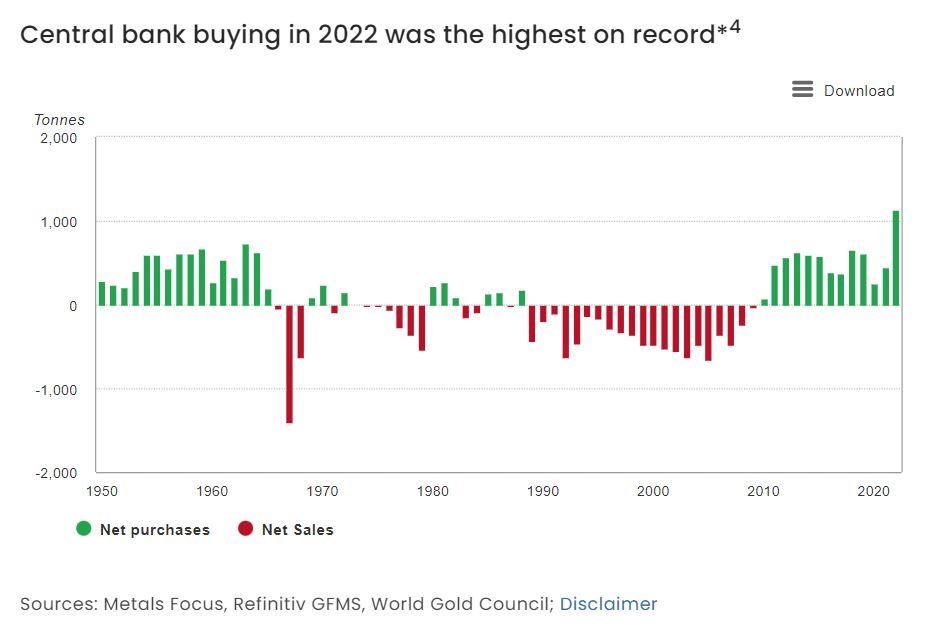

Stanley Druckenmiller sold shares of big tech names and bought shares of gold mining companies.He is another well known investor, who does have a history of buying gold.[7]

What do they see coming? Is it the end of BTFP?

New York Community Bank was one of the banks, along with the Federal Reserve and FDIC, to loan, bailout, and buy Signature Bank when it and Silicon Valley Bank were collapsing in March 2023. The program was called the Bank Term Funding Program (BTFP), for a term of one year, due back March 11. Their stocks started crashing in late January from $10 per share to $4.50 a week later. Moody’s credit rating agency downgraded NYCB to junk on February 6.[8][9]

Silicon Valley bank was the second largest bank failure in US history. Signature bank is the third.[10]

Are we about to experience an American depression? Actually, we already are. The American workforce has declined since 2019 while foreign born workers, most of them illegal immigrants, have taken the bulk of the job growth. So, while our economy looks good on paper, that is only if you count foreigners.

To quote Zerohedge’s February 3rd article, Inside The Most Ridiculous Jobs Report In Recent History,[11]

“Said otherwise, not only has all job creation in the past 4 years has been exclusively for foreign-born workers, but there has been zero job-creation for native born workers since July 2018!”

As of February 15, 2024, Germany, Japan, and the United Kingdom were in a recession. Jamie Dimon is selling shares of JP Morgan and Berkshire Hathaway is holding cash. Druckenmiller is buying gold mines. The stock price of New York Community Bank fell 60% in the first week of February. They bailed out Signature Bank. With the Bank Term Fuding Program allegedly expiring in March, we are in American recession already.

End Note: $8 trillion of the federal debt is due this year. The central banks are just going to print money. If they don’t, then Congress will blame them for not loaning Congress money. They’ll be scapegoated. Do you think that they’re dumb?[12]

Update March 6, 2024:

[3]https://www.youtube.com/watch?v=JP8cUvpD6Qk

[8]https://www.foxbusiness.com/markets/new-york-community-bank-agrees-purchase-failed-signature-bank

[9]https://ratings.moodys.com/ratings-news/414856

[10]https://www.hamiltonmobley.com/blog/silicon-valley-bank

[11https://www.zerohedge.com/economics/inside-most-ridiculous-jobs-report-recent-history

[12]https://www.hamiltonmobley.com/blog/turning-points-ii