October 30th and 31st

October 30th and 31st

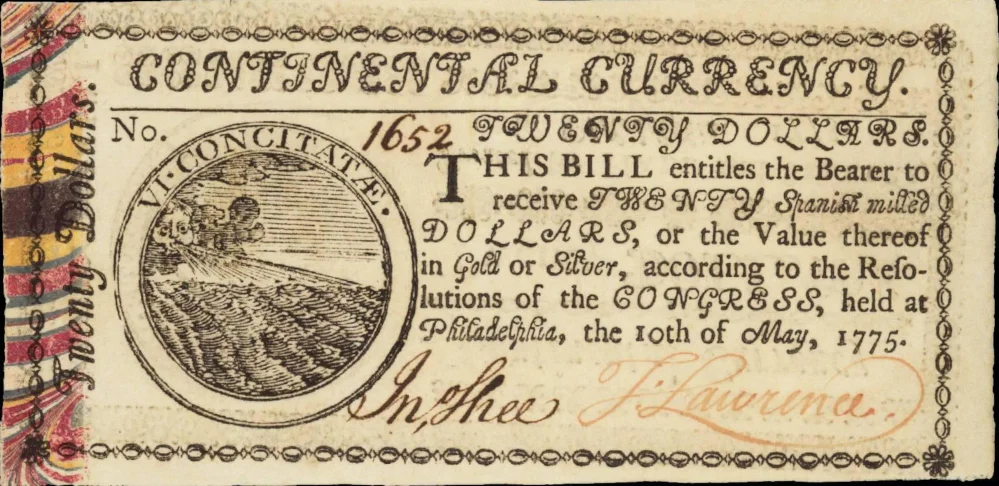

Gold would actually be a realistic investment in modern times since gold can’t be printed in real life and the dollar has been printed like crazy.

“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.” -Former Federal Reserve Chairman Alan Greenspan, Meet the Press, August 7, 2011.

Tomorrow, October 30th, The FOMC has their meeting to set interest rates and on Thursday, October 31st Brexit is supposedly going to happen to some extent.

The Fed will tank fixed income asset investments if they raise interest rates[1] and they are actively keeping interest rates low with “not QE,”[2] so they will lower or keep rates neutral. Gold and silver have been rising ever since the Fed stopped raising interest rates in June 19th,[3] causing the metals to break through a 5 year long $1,350 price ceiling; and have been hovering around $1,500 and $17.50 respectively, because the Fed has since cut rates twice on July 31st and September 18th.[4]

Brexit is so uncertain a topic that it ensures both that there will be investors that are not well hedged and also an increased interest in less risky assets, such as gold and silver.[5]

[1] https://www.hamiltonmobley.com/blog/interest-rates-and-inflation

[2] https://www.hamiltonmobley.com/blog/not-qe

[3] https://www.hamiltonmobley.com/blog/the-attack-on-the-petro-dollar

[4] https://www.cnbc.com/2019/09/18/fed-decision-interest-rates-cut.html

[5] https://www.hamiltonmobley.com/blog/three-opinions-on-gold