The Golden Age III

The COMEX is making historic physical gold deliveries. They are sourcing the gold from the LBMA, who is sourcing it from London bullion banks and the Bank of England. However, it is taking the BOE 4-8 weeks to ship the gold that normally takes a few days. Is this a bullion bank run?

The London Bullion Market Association (LBMA), the Commodities Exchange Market (COMEX), and now the Shangai Gold Exchange (SGE) are three of the biggest gold markets in the world. Dubai has a big gold market too.

Per the LBMA,[1]

“The world’s trade in bullion is London-based with a global reach of activity and participants. The roots of the London Bullion Market can be traced to the partnership between Moses Mocatta and the East India Company, who started shipping gold together towards the end of the 17th century. Shortly afterwards, while Sir Isaac Newton was master of the Royal Mint, gold in England was overvalued so it became more freely circulated than silver. This increased circulation quickly led to England having a gold based coinage, whereas the rest of Europe remained silver based until the 1850s.

[…]

By 1850, the five companies - N M Rothschild & Sons, Mocatta & Goldsmid, Pixley & Abell, Samuel Montagu & Co. and Sharps Wilkins - that 150 years later would form the London Gold Market Fixing Company, were already established and flourishing. The term London Gold Market refers to these five companies who formed to oversee the operation of the gold market in London. In 1919, it set up the first Gold Price fix at Rothschild's offices. The London Gold Market was also responsible for Good Delivery accreditations and the maintenance of the resulting List of Acceptable Melters and Assayers, as the List was originally known. The fact that London was at the centre of international time zones has always facilitated it being the perfect place from which to operate the market.

The Market's five members remained essentially unchanged for most of its history. But by the 1980s the development of the market was such that the Bank of England recognised that the custody, maintenance and regulation of the Good Delivery List required an independent body. This was the catalyst for the founding of the London Bullion Market Association in 1987.”

Lately, the LBMA has been making historic deliveries to the COMEX in New York.

Per Leslie Hook of the Financial Times on January 29th,[2]

“The wait to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks, according to people familiar with the process, as the central bank struggles to keep up with demand.

‘People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,’ said one industry executive. ‘Liquidity in the London market has been diminished.’”

Two theories offered are that Central Banks and nations are repatriating gold or that people are trying to avoid Trump’s proposed tariffs.

Indeed, on February 9th, Treasury Secretary Scott Bessent said that the USA would monetize the asset size of the US balance sheet over the next 12 months. Does that include the gold allegedly at Fort Knox? Are they buying gold from London to remonetize gold?

In addition, on January 27th, Jan Nieuwenhuijs wrote that China has been buying more gold than they have been declaring. He writes,[3]

“Since February 2023, I have been publishing evidence of the PBoC buying significantly more gold than what it reports to the IMF. These purchases have broken the West’s dominance in the market by driving the price higher (see here and here).

I found the smoking gun of the PBoC’s secret gold operations in November 2024. As private demand in China declined and premiums on the Shanghai Gold Exchange (SGE) turned negative in September, Chinese imports remained robust.”

What is happening is that most “gold” traded in the LBMA and COMEX is a paper contract backed by nothing. Until quite recently, most people were happy with taking their profits in dollars instead of getting gold physically delivered. Hence, bitcoin’s popularity. As the dollar declines in value against gold, people are wanting the real thing.

Per Chris Powell of GATA, writing at GoldSeek.com on January 31st,[4]

“The second problem with the tariff scare scenario is that U.S. bullion banks and traders lately have had no trouble using New York Commodities Exchange futures contracts to obtain gold in London via the ‘exchange for physical’ and ‘exchange for risk’ mechanisms of fulfilling futures obligations. The bullion banks do gold business in both cities and gold can be sold for cash in London and the cash wired back to the United States.”

Confusingly, accepting cash instead of gold as payment is called “exchange for physical.”

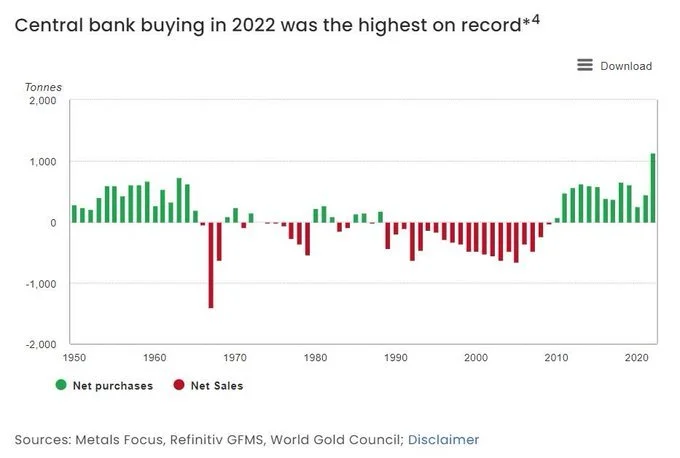

Considering that Congress has to either vote on more debt or to drastically cut spending in March, that gold is at an all time high of $2,925, and that Central Banks started a bank walk on gold in reaction to the 2008 Great Recession, this might be a bullion bank run as the US dollar is replaced as the world’s reserve currency.

End Note: Some people think that bitcoin is better than gold. Bitcoin is a dollar denominated asset. People with bitcoin have an asset worth 100,000 depreciating dollars, but bitcoin won’t be more valuable at $1,000,000 if the dollar is worthless. At that point, bitcoin will be worth its weight in gold.

[1]London Gold and Silver Vault Data for January 2025 | LBMA

[2]Gold stockpiling in New York leads to London shortage

[3]SCOOP: China Continues Making Covert Gold Purchases in London

[4]What If the Shortage of Gold in London Isn’t a Tariff Scare but ... A Shortage of Gold? | GoldSeek