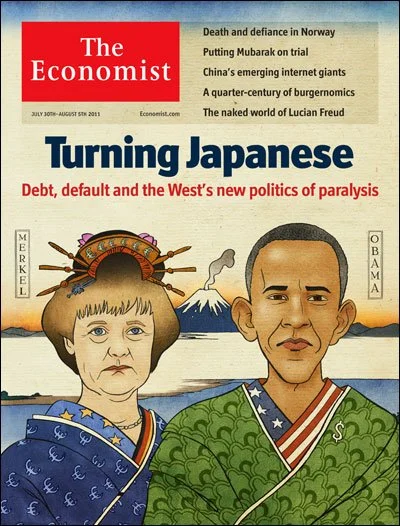

Turning Japanese

In the 1980’s, many believed that Japan would take over the world. Instead, starting in the 1990’s, Japan had years of stagnant growth because their government kept printing money. The Federal Reserve (Fed) is supposed to sell US government bonds to raise interest rates tomorrow, June 15, 2022. The Bank of Japan is trying to keep the Yen from inflating as they continue to inflate the Yen. This can be done by selling the US government bonds that they own. The Fed may not be able to raise interest rates for long without the bond market crashing because the US (Fed and Social Security) and the Japanese are the biggest buyers of US debt. So they may soon have to resume printing money to buy US government debt. The US are turning Japanese.

The Yen is falling in dollar price as the Bank of Japan has printed Yen to suppress interest rates to keep their economy from imploding (printing money lowers interest rates).

Via Reuters,[1]

“TOKYO, April 28 (Reuters) - The Bank of Japan on Thursday strengthened its commitment to keep interest rates ultra-low by vowing to buy unlimited amounts of bonds daily to defend its yield target, triggering a fresh sell-off in the yen and sending government bonds rallying.

Reinforcing its resolve to support a fragile economy even as sharp rises in raw material costs push up inflation, the BOJ maintained its ultra-loose monetary policy and a pledge to keep interest rates at ‘present or lower levels.’"

While they stopped the unlimited buying after 4 days, they are still buying. Buying Japanese government debt by printing money is making the Yen worth less. On June 10, the BOJ, the Japanese Finance Ministry, and the Japanese Financial Services Agency released a joint statement affirming that they are worried about the decline of the Yen’s dollar price.

Via the Japan Times,[2]

"TOKYO, June 10 (Reuters) - Japan's government and central bank said on Friday they were concerned by recent sharp falls in the yen in a rare joint statement, the strongest warning to date that Tokyo could intervene to support the currency as it plumbs 20-year lows.

[…]

‘We have seen sharp yen declines and are concerned about recent currency market moves,’ the Finance Ministry, BOJ and the Financial Services Agency said in a joint statement released after their executives' meeting.

Officials of the three institutions meet occasionally, usually to signal to markets their alarm over sharp market moves. But it is rare for them to issue a joint statement with explicit warnings over currency moves.”

The Japanese government could increase the dollar price of the Yen by buying the Yen at a high price on the foreign exchange market with the dollars that they own. The dollar price of the Yen is important because the dollar has been the currency used for international trade post WWII. Japan mostly owns dollars in the form of US government bonds. They would sell the bonds to get the dollars.[3]

Bonds can be bought and sold, and not necessarily at 1:1. For example, someone selling $100 worth of 10 year US government bonds at 3% interest might not find any buyers at $100 because, as the dollar becomes worth less, more people would prefer to buy lower yielding bonds at a discount to match the decline in the value of the dollar. Instead of buying the debt at 1:1 at $100, buyers may wish to buy it at $97 or as low as $50 or $10. There is no sale without a buyer. To prevent this, the Fed would need to print money and buy those bonds at $100, just like the BOJ is doing with Japanese government debt.

This would be a problem for the dollar because the Fed has indicated that they will be raising the Federal Funds Rate for the foreseeable future. The Fed raises rates by selling US government bonds. If the Japanese begin selling US government bonds while the Federal Reserve is trying to raise the Federal Funds Rate, then it may cause the Fed to quickly reverse course by printing dollars buy those bonds to keep their price from declining, lowering the Federal Funds Rate. That could mean that the only people willing to buy US government bonds at low interest rates would be the Fed turning Japanese.[4][5]

The Fed is stuck between a rock and a hard place. Either the Fed acts as the lender of last resort and the dollar becomes worth less and worthless, or it stops printing money, raises interest rates, dries up the supply of affordable loans, and causes defaults on a record scale.

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.” -Jerome Powell, Chairman of the Federal Reserve, then member of the Board of Governors, Oct 2012 Federal Open Market Committee Meeting.

In the 1980’s, many believed that Japan would take over the world. Instead, starting in the 1990’s, Japan had years of stagnant growth because their government kept printing money. The Federal Reserve (Fed) is supposed to sell US government bonds to raise interest rates tomorrow, June 15, 2022. The Bank of Japan is trying to keep the Yen from inflating as they continue to inflate the Yen. This can be done by selling the US government bonds that they own. The Fed may not be able to raise interest rates for long without the bond market crashing because the US (Fed and Social Security) and the Japanese are the biggest buyers of US debt. So they may soon have to resume printing money to buy US government debt. The US are turning Japanese.

[2]https://www.japantimes.co.jp/news/2022/06/10/business/yen-boj-government-warning/

[3]https://www.youtube.com/watch?v=yWopCl1YlQQ

[4]https://www.hamiltonmobley.com/blog/printing-money-lowers-interest-rates

[5]https://fred.stlouisfed.org/series/FEDFUNDS “The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity.”