¥en Yang

As of yesterday, Wednesday, April 10, 2024, it now takes ¥153 to get $1. The Bank of Japan can strengthen the ¥en by selling US government bonds. They could then sell the dollars that they get from the bonds for ¥en on the open market for less than ¥153. It is a cheap trick, but it will yank around the Federal Reserve, who will need to be the lender of last resort to the US government if Japan and China are selling. That means more inflation for the USA, and a weakening US dollar. Talk about Yin Yang!

Yesterday, the yen broke above ¥152 to ¥153 per dollar.

This is a level that goes back over 30 years.

That same day, President Biden was meeting with Japanese Prime Minister Kishida.

According to the Zerohedge article, Biden (Yes, Biden) Promises Rate-Cut By Year-End As Fed Minutes Signal Caution But QT Taper 'Fairly Soon',[1]

“President Biden chimed in on Fed policy...

‘Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut,’ Biden said Wednesday at a White House press conference alongside Japanese Prime Minister Fumio Kishida, adding that today's CPI report could delay a rate cut by at least a month...”

So, it appears that Biden, or to be accurate, his handlers, are aware that the Fed needs to cut rates (by printing money to buy US government bonds that the Treasury is selling to big banks to finance our current deteriorating standard of living), but that printing money will make everything expensive (CPI report).

The Fed is stuck between a rock and a hard place. Either the Fed acts as the lender of last resort and the dollar becomes worth less and worthless, or it stops printing money, raises interest rates, dries up the supply of affordable loans, and causes defaults on a record scale.

With China and Japan, historically the largest buyers of US debt, selling US debt, the Fed may have to do a ton of printing.[2]

Indeed, the Chinese economy is collapsing, and they need money.[3][4]

According to dictionary.com,[5]

“Yin-yang refers to a concept originating in ancient Chinese philosophy where opposite forces are seen as interconnected and counterbalancing.”

The Fed is being jerked around as the ¥en, and all currencies, respond to their Yankee Yang.

The Yin Yang is being reflected in the gold price too.

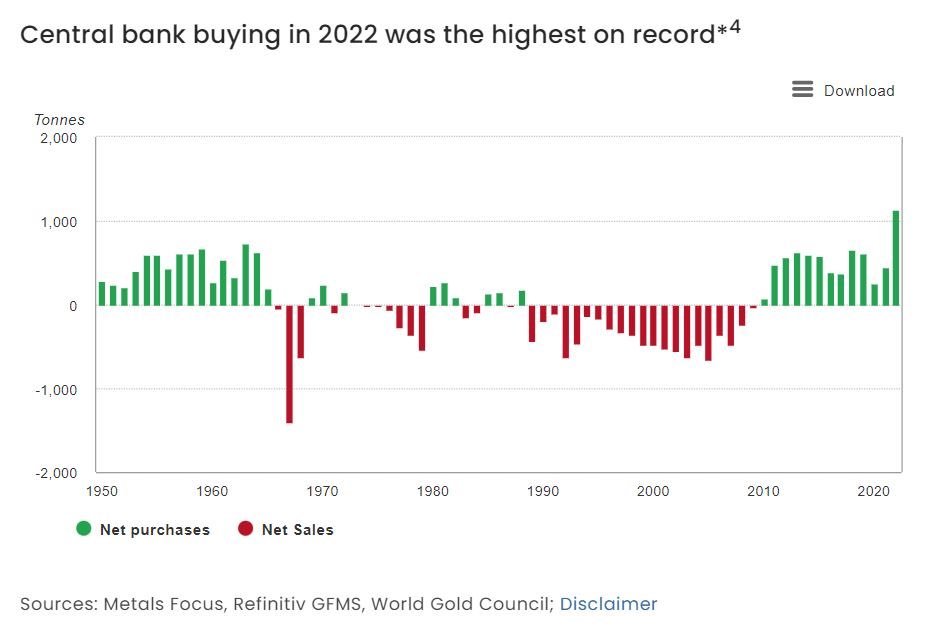

No wonder central banks have been buying gold since the 2008 Great Recession, buying the dip from 2013-2020. They know how the paper dollar will balance out against gold.

As of yesterday, Wednesday, April 10, 2024, it now takes ¥153 to get $1. The Bank of Japan can strengthen the ¥en by selling US government bonds. They could then sell the dollars that they get from the bonds for ¥en on the open market for less than ¥153. It is a cheap trick, but it will yank around the Federal Reserve, who will need to be the lender of last resort to the US government if Japan and China are selling. That means more inflation for the USA, and a weakening US dollar. Talk about YinYang!

[2]https://www.hamiltonmobley.com/blog/turning-points

[3]https://www.youtube.com/watch?v=bnjl-9Qyfh0