On August 15, 1971, President Richard Nixon defaulted on US gold payments. He said, “I am now a Keynesian in economics.”

To the Church

James 5:1 “Come, you men of riches, bemoan yourselves and cry aloud over the miseries that are to overtake you. Corruption has fallen on your riches; all the fine clothes are left moth-eaten, and the gold and silver have long lain rusting. That rust will bear witness against you.”

Gold Price Suppression

The gold price has been suppressed in dollar terms because ETF’s and Bitcoin (digital gold) have diverted demand from physical gold to paper/digital gold.

Warnings

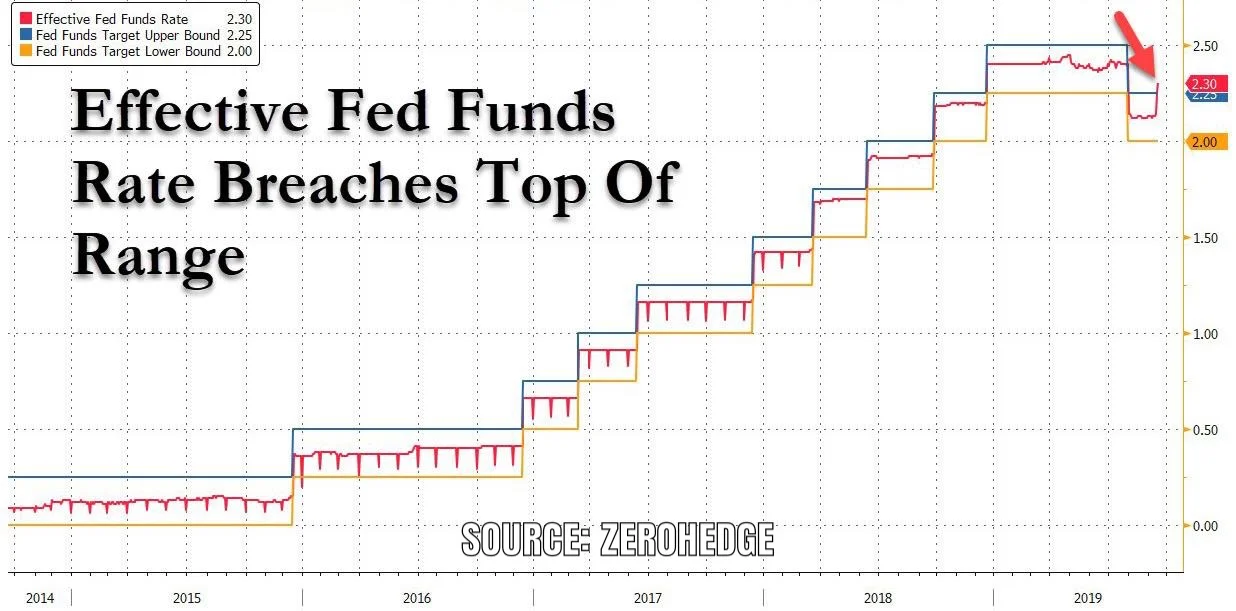

The December 2000 rate cut preceded the recession in March 2001 and the July 2007 rate cut preceded the Great Recession beginning in December 2007. July 2019 was the first rate cut since 2008 and occurred 4 months ago as of November.

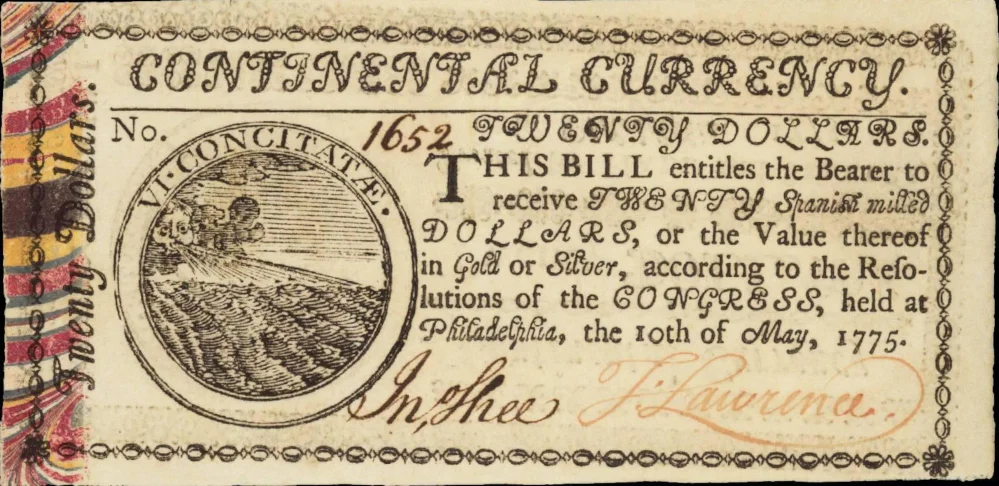

Not Worth a Continental

The phrase, “Not worth a Continental,” will soon be commonly known for the same reasons that it was said in the early Republic: the USA are broke and the paper money is becoming worthless.

October 30th and 31st

“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.” -Former Federal Reserve Chairman Alan Greenspan, Meet the Press, August 7, 2011.

Global Unrest

The protests are generally aimed at governments taxing and regulating people out of the middle class.

The Dutch National Bank and the (former) CEO of Overstock.com

“Stocks, bonds and other security: everything is at risk... If the whole system collapses, the gold stock offers a collateral to start over. Gold gives confidence in the power of the central bank's balance sheet.”

Augustus or Cincinnatus

“The United States and Italy are bound together by a shared cultural and political heritage dating back thousands of years to ancient Rome.” -President of the USA, Donald Trump.

Not QE

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

The SPDR GLD Prospectus

Does a person buying an ETF buy gold? The SPDR GLD Prospectus is researched as an example.

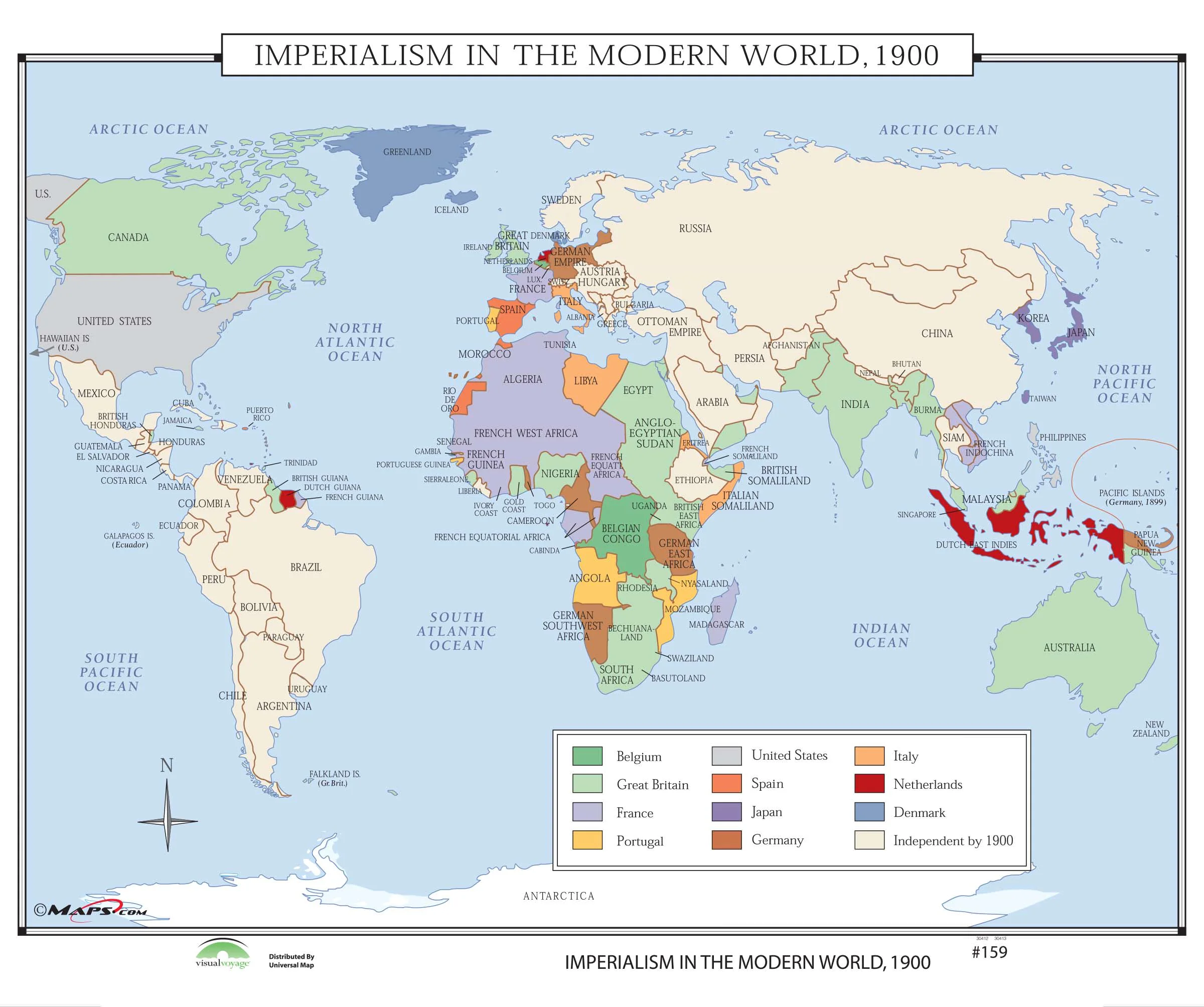

The Rise and Fall of the New Roman Empire

From 1492-1914 the New Eastern Romans and New Western Romans discovered, conquered, and colonized the majority of the world; spreading their common Greco-Roman culture. In 2019, the USA has been bankrupted by foreign wars, debt, and Socialism. The USA, like the Western Romans, have transformed from a Republic to an Empire.

IORR, IOER, and FFR

This article seeks to explain how interest rates are set by the Fed. The subject is meant to sound complicated but it is not once one understands that the Fed is trying to keep interest rates low to inflate the stock, housing, and bond bubbles.

Fractional Reserve Banking

Fractional Reserve Banking, also known as fraud, is where a bank only keeps 10% of the cash it claims to deposit and lends out the rest.

Risky Debt and the Repo Rate

Bread and Circus only works so long as the taxpayer can afford the debt.

The Attack on the Petro-Dollar

The attack on Saudi oil production was an attack on the petro-dollar. If the FOMC raises interest rates on September 18, the everything bubble could pop. If they keep interest rates the same or lower interest rates, the gold price could go higher, weakening demand for the dollar.

The MAGA Question

When was America ever great?

Basel III Banking Regulations

Excerpts from the Basel Committee on Banking Supervision’s regulations: Basel III: Finalising post-crisis reforms. Notably, gold is considered to be on par with cash. That probably has something to do with why central banks have been net buyers of gold since 2008 for the first time since 1987

Give Unto Caesar What Is Caesar’s and to God What Is God’s

Bring me a denarium, and let me look at it. When they brought it, he asked them, Whose is this likeness? Whose name is inscribed on it? Caesar’s, they said.

Bitcoin vs Gold (and Silver)

Bitcoin is digital gold. Is it better than physical gold?