Pump It Up!

The Federal Reserve voted to cut the Federal Funds Rate by half a percent today, publishing their decision at 9AM Central Time.

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.”[1]

The vote to set interest rates was originally scheduled for March 18 so this was an emergency rate cut.[2]

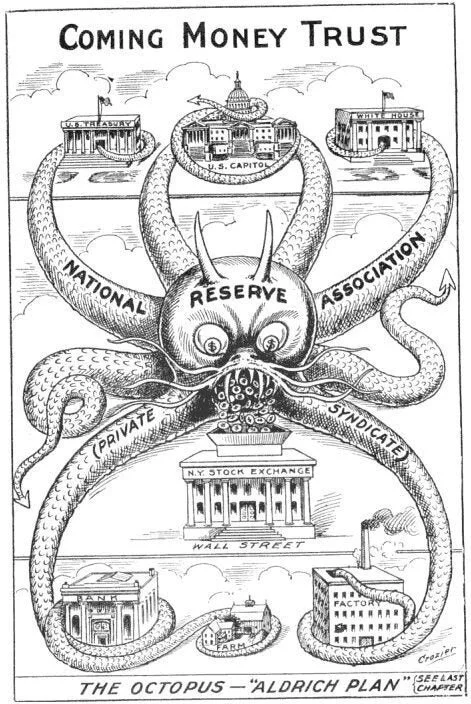

The Fed cuts rates by printing money.[3]

Stocks and gold jumped higher on the news.

“The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” -Ludwig von Mises, Human Action, pg. 570.

Update: President Donald Trump wants even moar inflation! Less than an hour later he tweeted,

“The Federal Reserve is cutting but must further ease and, most importantly, come into line with other countries/competitors. We are not playing on a level field. Not fair to USA. It is finally time for the Federal Reserve to LEAD. More easing and cutting!”[4]

[1]https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

[2]https://www.federalreserve.gov/newsevents/pressreleases/monetary20200303a.htm

[3]https://fred.stlouisfed.org/series/fedfunds “The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target. […] Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade.”

[4] https://mobile.twitter.com/realDonaldTrump/status/1234869067892305923