Pumping Money Into the Economy

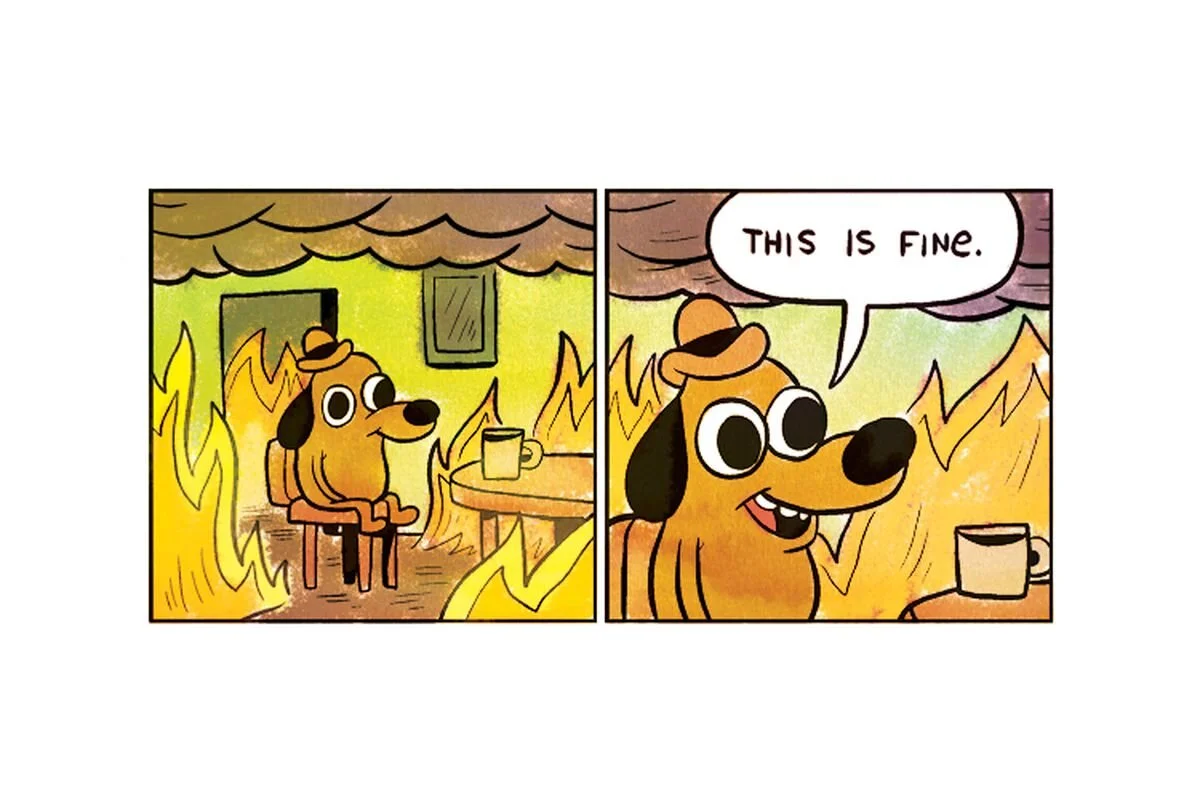

President Donald Trump and Federal Reserve Chairman Jerome Powell are foreshadowing inflation.

Chairman Powell put out a press release on Friday, February 28th stating,

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”[1]

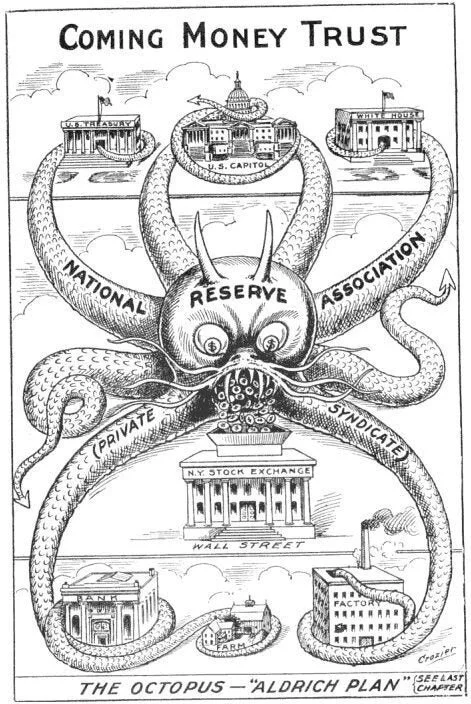

The Fed supports the economy (stock market and taxpayer debt) by printing money.

President Donald Trump tweeted out today that the Fed needs to pump out more money to keep interest rates low.

“As usual, Jay Powell and the Federal Reserve are slow to act. Germany and others are pumping money into their economies. Other Central Banks are much more aggressive. The U.S. should have, for all of the right reasons, the lowest Rate. We don’t, putting us at a competitive disadvantage. We should be leading, not following!”[2]

They know that printing money to keep interest rates low is the only way to keep demand for stocks and bonds from collapsing.[3]

[1] https://www.federalreserve.gov/newsevents/pressreleases/other20200228a.htm

[2] https://mobile.twitter.com/realDonaldTrump/status/1234497829298679809

[3] https://www.hamiltonmobley.com/blog/interest-rates-and-inflation?rq=Inflation