Fear Trades

Fear is not a bad thing in economics. It is just a fact to be calculated.

Fear trades- goods and services that people are willing to buy when they are afraid of a general market downturn- are catching bids. Gold is up, the dollar is up, and gov bond yields are down. Yields go down as demand for debt bonds increases.

However, the US stock market is down after big sell-offs on Monday and Tuesday. That sell-off would imply that the US stock market is losing status as a safe haven trade.

The global supply chain is being choked off by quarantines restricting trade.

Proctor and Gamble has announced that over 1,700 items could be in short supply since they are imported, partially or wholly, from China.[1]

Borders are being closed and travel is being restricted across the world.[2] It seems that when China sneezes, the whole world catches a cold.

Gold is hitting record highs in the Euro and Pound. It is near record highs for the Japanese Yen and the Chinese Yuan/Renminbi. Gold is at a 7 year high in the Dollar with no obvious price ceiling.[3]

US treasury bonds are yielding record lows, implying that demand for treasuries has increased out of fear of losing money elsewhere because US treasuries are typically seen as safe-haven investments.

Writing in an article entitled Stock Market Bloodbath at the Unz Review, Mike Whitney states,

“On Tuesday, the benchmark 10-year Treasury yield fell to a record low of 1.32% while the 30-year Treasury dropped more than 3 basis points to a new all-time low of 1.7%. These rates are considerably lower than they were immediately following the terrorist attack on 9-11 which attests to the level of terror that has engulfed trading floors across the planet.”[4]

The dollar is up[5] since the emergence of the Coronavirus while gold is also up. When the dollar is up, gold is usually down. This implies that, potentially as a result of inflation fears, the dollar may not seen as the ultimate safe haven trade like it has been since the end of WWII.

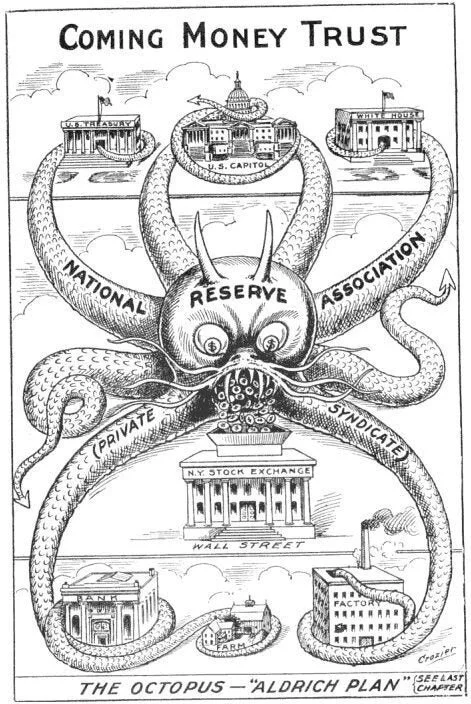

As investors continue to buy US government bonds and the dollar, central bankers and governments are promising to print and spend more money.[6][7][8] This will devalue their currencies (and thus bond profits) and is a big reason for gold not having an obvious price ceiling in any currency. Central bank purchases with newly created money are also why insolvent governments have the demand to sell their bonds at low yields to finance their insolvency.

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.” -Jerome Powell, Chairman of the Federal Reserve, then member of the Board of Governors, Oct 2012 Federal Open Market Committee Meeting.

Fear trades are starting to become popular. Once US dollar and US bond holders realize that their paper profits will be inflated away by central bankers who are afraid of allowing interest rates to rise, then gold will see record highs in all currencies as people sell their dollars and dollar denominated assets.

For instance, the Dow lost over 1,800 points (~6%) Monday and Tuesday. Stock markets are down generally from near all time highs since the news of the Coronavirus supply chain shutdown emerged at the beginning of the year.[9]

US stocks have been seen as safe haven trades. That could be changing as of yesterday.

However, central banks could continue to prop up stock prices at the expense of the dollar’s purchasing power with low interest rates and monetary inflation in an inflationary stock market recession.[10]

Or the central bankers could allow rates to rise and pop bubbles while historically indebted governments go bankrupt as investors sell their paper currency assets to buy safe havens like gold.

Either way, central bankers are buying gold. Is gold their fear trade?

[4] https://www.unz.com/mwhitney/stock-market-bloodbath/

[5]https://www.bloomberg.com/quote/DXY:CUR

[6] https://www.zerohedge.com/geopolitical/france-confirms-2nd-death-outbreak-spreads-across-europe-virus-arrives-south-america “According to Fox's Chad Pergram, Chuck Schumer is planning a $8.5 billion package that he plans to hand over to the appropriations committee later on Wednesday.”

[8] https://www.zerohedge.com/markets/china-injects-record-5-trillion-new-debt-arrest-economic-crash

[9] https://www.marketcrumbs.com/post/stocks-extend-their-decline-as-reality-begins-to-set-in

[10] https://www.hamiltonmobley.com/blog/inflationary-stock-market-recessions