Taking Advantage of Long Term Rates

Treasury Secretary Steven Mnuchin was on CNBC this morning speaking with Jim Cramer about financing the $3 trillion that the government has been borrowing since April through June.[1]

Mr. Cramer asked about the Federal government refinancing the debt because interest rates are so low. The secretary responded,

“Jim, we’re absolutely doing that. So, let me be clear, one of the things I’ve said is… One of the reasons I do feel comfortable with us spending all this money is because interest rates are very low and we’re taking advantage of long term rates.

[…]

We’re going to take advantage of refinancing all of our debt to make sure that we have very low rates.”

Of course interest rates are low. The Federal Reserve has the power to lower interest rates. Printing money to buy debt is how the Fed lowers interest rates, specifically the Federal Funds Rate which influences all other interest rates.[2]

The Federal Reserve Economic Data department states on their website,

“The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.

[…]

Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade.”[3]

The Former Chairman of the Federal Reserve, Alan Greenspan made it explicit during an interview with Meet the Press, on August 7, 2011. He said,

“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.”[4]

If they don’t inflate the money supply, the current Chairman of the Fed thinks that there will be a depression.

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.” -Jerome Powell, Chairman of the Federal Reserve, then member of the Board of Governors, Oct 2012 Federal Open Market Committee Meeting.

Of course, the USA are already in a depression. The reason is that printing money to loan out to insolvent governments does not work in the long run.

“The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” -Ludwig von Mises, Human Action, pg. 570.

The Fed will bail out the Federal government. The money will just be worth less and eventually worthless.

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.” -Fed Chairman Alan Greenspan, US Senate Committee on Banking, Housing and Urban Affairs, Feb 16, 2005.

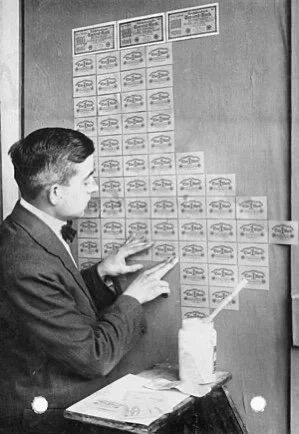

Treasury Secretary Mnuchin should know the consequences of printing money. His name is signed on every newly printed dollar bill which are legally known as Federal Reserve Notes.

[1]https://www.hamiltonmobley.com/blog/6hc77l5rzp81iawadkxb09difpcyuf

[2]https://www.hamiltonmobley.com/blog/iorr-ioer-and-ffr

[3] https://fred.stlouisfed.org/series/fedfunds

[4]https://www.realclearpolitics.com/video/meet_the_press/2011/08/07/