Inflation to Wear Away the Debt

Three employees of the Fed, Franceso Bianchi, Renato Faccini, and Leonardo Melosi are writing a working paper to see what would happen if the Federal Reserve inflated away the US debt.

“The Covid-19 pandemic hit the U.S. economy at a time in which the ability of policymakers to react to adverse shocks is greatly reduced. The current low interest rate environment limits the tools the central bank can use to stabilize the economy, while the large public debt curtails the efficacy of fiscal interventions by inducing expectations of costly fiscal adjustments. Against this background, we study the implications of a coordinated fiscal and monetary strategy aimed at creating a controlled rise of inflation to wear away a targeted fraction of debt. Under this coordinated strategy, the fiscal authority introduces an emergency budget with no provisions on how it will be balanced, while the monetary authority tolerates a temporary increase in inflation to accommodate the emergency budget. In our model, the coordinated strategy enhances the efficacy of the fiscal stimulus planned in response to the Covid-19 pandemic and allows the Federal Reserve to correct a prolonged period of below-target inflation. The strategy results in only moderate levels of inflation by separating long-run fiscal sustainability from a short-run policy intervention.”[1]

The paper concludes that monetary inflation won’t result in too much price inflation so the Fed can keep the US government solvent for a little longer.

President Trump said that he even wants the Fed to inflate the money supply so much that interest rates go negative.

“As long as other countries are receiving the benefits of Negative Rates, the USA should also accept the ‘GIFT’. Big numbers!”.[2]

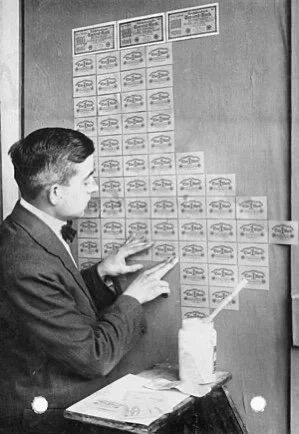

The monetary inflation is already here and more is coming.[3] Price inflation is next.

“But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against ‘real’ goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.” -Ludwig von Mises, Human Action (1949), page 428.

[1]https://www.chicagofed.org/publications/working-papers/2020/2020-13

[2]https://mobile.twitter.com/realDonaldTrump/status/1260206276216266754

[3]https://www.hamiltonmobley.com/blog/6hc77l5rzp81iawadkxb09difpcyuf