Health and Wealth

The Coronavirus is being blamed for the current depression by Federal Reserve Chairman Jerome Powell.

However, just as unhealthy people can die from the common cold, the catalyst for the depression is the Coronavirus quarantines but the reason is taxation, regulations, debt, and inflation.

Chairman Powell was interviewed by Scott Pelley of 60 Minutes[1] on May 13th (published May 17th) and testified before the US Senate’s Committee on Banking, Housing, and Urban Affairs[2] on May 20th.

Per the script of his 60 Minutes interview, he blames the economic downturn on the Coronavirus and salvation comes from the government.

“PELLEY: In terms of stimulus, has the Congress done enough?

POWELL: The Congress has done a great deal and done it very quickly. There is no precedent in post-World War II American history that's even close to what Congress has done. They have passed $3 trillion in stimulus, which is 14% of GDP. It is vastly larger than anything they've ever done. And also very, very quick. So a lot of that money is just starting to flow through the economy. And it's going to help households and businesses in coming months. The thing is that the coronavirus shock is also the biggest shock that the economy's had in living memory.

However, the quarantines (coronavirus shock) were implemented and enforced by the governments of these United States. People were not legally allowed to engage in commerce.

The government is good at breaking your legs and then taxing your neighbor to give you crutches.

In his prepared remarks before the Senate, Chairman Powell wrote,

“In discussing the actions we have taken, I will begin with monetary policy. In March, we lowered our policy interest rate to near zero, and we expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.

In addition to monetary policy, we took forceful measures in four areas: open market operations to restore market functioning; actions to improve liquidity conditions in short-term funding markets; programs in coordination with the Treasury Department to facilitate more directly the flow of credit to households, businesses, and state and local governments; and measures to allow and encourage banks to use their substantial capital and liquidity levels built up over the past decade to support the economy during this difficult time.”

However, the Federal Reserve had already been lowering interest rates since July 2019 and has been expanding their balance sheet since September 2019. So the economy must have already been unhealthy prior to the “coronavirus shock.”[3][4]

The US government will continue to spend the money that the Fed prints digitally to loan them so that Americans can pay their bills. Chairman Powell admits as much in his 60 Minutes interview.

And the question is, will it be enough? And I don't think we know the answer to that. It may well be that the Fed has to do more. It may be that Congress has to do more. And the reason we've got to do more is to avoid longer run damage to the economy.

If we let people be out of work for long periods of time, if we let businesses fail unnecessarily, waves of them, there'll be longer term damage to the economy. The recovery will be slower. The good news is we can avoid that by providing more support now.[…]

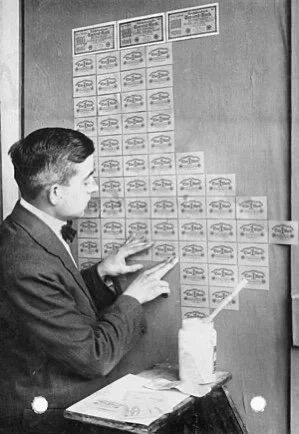

PELLEY: Fair to say you simply flooded the system with money?

POWELL: Yes. We did. That's another way to think about it. We did.

PELLEY: Where does it come from? Do you just print it?

POWELL: We print it digitally. So as a central bank, we have the ability to create money digitally. And we do that by buying Treasury Bills or bonds for other government guaranteed securities. And that actually increases the money supply. We also print actual currency and we distribute that through the Federal Reserve banks.”

The economist Ludwig von Mises knew the endgame over half a century ago.

“But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against ‘real’ goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.” -Human Action (1949), page 428.

The government can spend as much as the Fed loans them but they can only buy what the money is worth.

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.” -Fed Chairman Alan Greenspan, US Senate Committee on Banking, Housing and Urban Affairs, Feb 16, 2005.

Too bad printing money doesn’t increase our health or our wealth.

The USA have replaced the Ottoman Empire and the Soviet Union as the sick man of Europe. Our only saving grace is that every other country in the world is just as bad or worse.

[2]https://www.federalreserve.gov/newsevents/testimony/powell20200519a.htm

[3] https://www.hamiltonmobley.com/blog/warnings “[T]he Fed cutting interest rates preceded a recession by a few months. The December 2000 rate cut preceded the recession in March 2001 by 3 months and the July 2007 rate cut preceded the Great Recession beginning in December 2007 by 5 months. July 2019 was the first rate cut since 2008 and ocurred 4 months ago as of November.”

[4]https://www.hamiltonmobley.com/blog/gm0y7pp8tk6fltxk1jjvnwsk1wsfwd “The Fed is already stuck in a liquidity trap as they had been gradually raising interest rates since December 2015 because the economy had been improving.[3] However, on July 31st and September 18th, 2019 the Fed began lowering rates (buying assets)[4] in preparation for a downturn and then in response to the September 15th and 16th repo crisis.”