Arbitrage

According to dictionary.com, arbitrage is “the simultaneous purchase and sale of the same securities, commodities, or foreign exchange in different markets to profit from unequal prices.” Over the past two weeks, the price of gold in Shanghai, China has been selling at ~$2,000, which is about $100 higher than the spot price at $1,900. This is not common. That means that people could be buying gold in the West and selling it in the East at a profit, moving gold to China. He who has the gold makes the rules. The world speaks English for a reason.

Typically, the price of gold is set by the LBMA in London, England, UK and the COMEX in Chicago, Illinois, USA.

Per Taylor DeJesus, writing for money.com[2]

“Numerous factors influence gold pricing, so no one person or organization is fully responsible for setting prices. However, the London Bullion Market Association (LBMA) publishes gold prices twice a day via the ICE Benchmark Administration (IBA). The IBA consists of multiple banks, an oversight committee and a panel of internal and external chair members. The IBA sets gold spot prices and gold fixed prices based on supply and demand as well as the gold futures derivative markets.

The major derivative markets include the Commodity Exchange (COMEX) in the U.S. and the LBMA in the U.K. The COMEX and LBMA make futures contracts with buyers that agree to pay a certain price for gold that they will receive at a specific time in the future. Combined with supply and demand information, the IBA can determine the spot price, which is the market price of unrefined gold. The IBA then sets a gold price to publish as the LBMA Gold Price, or the London Gold Fix.”

However, the gold in the Shangai Gold Exchange has been trading at about $100 higher than the spot price set in the West, and has been for about 2 weeks. That means that people could be buying gold in the West and selling it in the East at a profit, moving gold to China.[3-8]

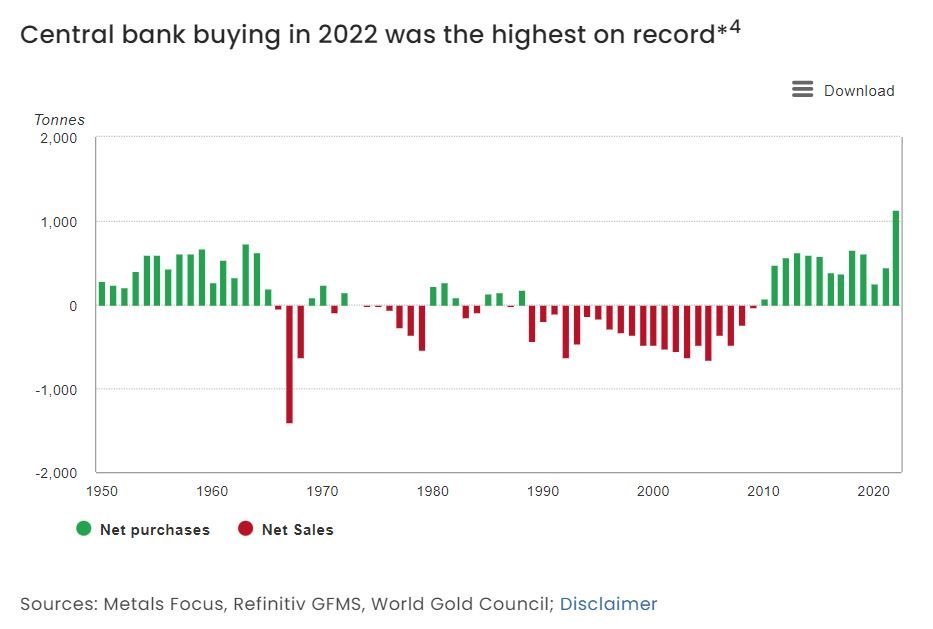

He who owns the gold makes the rules. That is why central banks and nations have been buying and repatriating their gold after the US Federal Reserve started printing dollars and buying assets to prop up the markets in response to the 2008 Great Financial Crisis. The dollar is not as good as gold.

Silver has a similar arbitrage.[8]

According to dictionary.com, arbitrage is “the simultaneous purchase and sale of the same securities, commodities, or foreign exchange in different markets to profit from unequal prices.” Over the past two weeks, the price of gold in Shanghai, China has been selling at ~$2,000, which is about $100 higher than the spot price at $1,900. This is not common. That means that people could be buying gold in the West and selling it in the East at a profit, moving gold to China. He who has the gold makes the rules. The world speaks English for a reason.

[1]https://www.dictionary.com/browse/arbitrage Arbitrage definition.

[3]https://twitter.com/oriental_ghost/status/1706217292730900696

[4]https://twitter.com/GarrettGoggin/status/1706260359827353802

[5]https://www.youtube.com/watch?v=X5bwQMRJ5nQ

[6]https://www.youtube.com/watch?v=q78VWA9AE40

[7]https://www.youtube.com/watch?v=NU9jFtiWJgQ&t=232s

[8]https://twitter.com/IJCarrasco/status/1702269311941784036