Bank Walks

Citizens Bank, out of Sac City, Iowa was about to default on November 3, so the Federal Deposit and Insurance Company (FDIC) helped the Iowa Trust & Savings Bank bail them out. That same day, depositors couldn’t deposit money into Bank of America, US Bank, Chase Bank, Wells Fargo, and Truist Bank. They, therefore, can’t use that money. Considering the bank bailouts earlier in the year, is the banking system walking into a bank run?

On November 3, the FDIC put out a statement, stating,[1]

“WASHINGTON — Citizens Bank, Sac City, Iowa, was closed today by the Iowa Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC entered into a Purchase and Assumption Agreement with Iowa Trust & Savings Bank, Emmetsburg, Iowa, to assume all of the deposits of Citizens Bank.

The two branches of Citizens Bank will reopen as branches of Iowa Trust & Savings Bank on Monday during normal business hours. This evening and over the weekend, depositors of Citizens Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

Depositors of Citizens Bank will become depositors of Iowa Trust & Savings Bank, so customers do not need to change their banking relationship in order to retain their deposit insurance coverage. Customers of Citizens Bank should continue to use their existing branch until they receive notice from Iowa Trust & Savings Bank that it has completed systems changes to allow its branch offices to process their accounts as well.

As of September 30, 2023, Citizens Bank had approximately $66 million in total assets and $59 million in total deposits. In addition to assuming all of the deposits, Iowa Trust & Savings Bank agreed to purchase essentially all of the failed bank’s assets.”

This is the 5th US bank bail out this year. Additionally, multiple banks were reported as having problems with their bank accounts.[2]

Per Reuters,[3]

“Nov 3 (Reuters) - Bank of America's (BAC.N) mobile app flashed a message on Friday that said customers could be facing temporary delays in depositing funds into their accounts after a technical glitch impacted multiple financial institutions.

The issue could be stemming from The Clearing House (TCH), a core payments system infrastructure owned by some of the largest commercial banks in the world.”

Per Mirror based out of the UK,[4]

“Banking companies Truist, Bank of America, Chase, US Bank, and Wells Fargo were experiencing delays in the posting of direct deposits today.

The disruptions reportedly began at around 8am ET and seem to have concluded at 1:30pm ET. Customers reported experiencing delays in the posting of their direct debit deposits and paychecks. Wells Fargo first acknowledged the issue on social media and said they were working towards a resolution. Bank of America also acknowledged the issue in a message to customers.”

The bank deposit delays are actually still ongoing.

Per Matt Egan, writing for Yahoo!Finance on November 7th,[5]

“Federal Reserve officials are urging banks to work with customers hurt by ongoing deposit delays that have prevented some people from accessing their paychecks and other funds.

A number of customers still haven’t received their direct deposit paychecks following a ‘human error’ that damaged the plumbing of America’s banking system. The deposit delays are linked to a problem that emerged on Friday with the Automated Clearing House (ACH) payments system, causing headaches for consumers and employers.”

Considering the bank bailouts earlier in the year, is the banking system walking into a bank run? Yes. See the 6th through 11th reference at the bottom of this post to read the author’s perspective as it happened over the past year.[6-11}

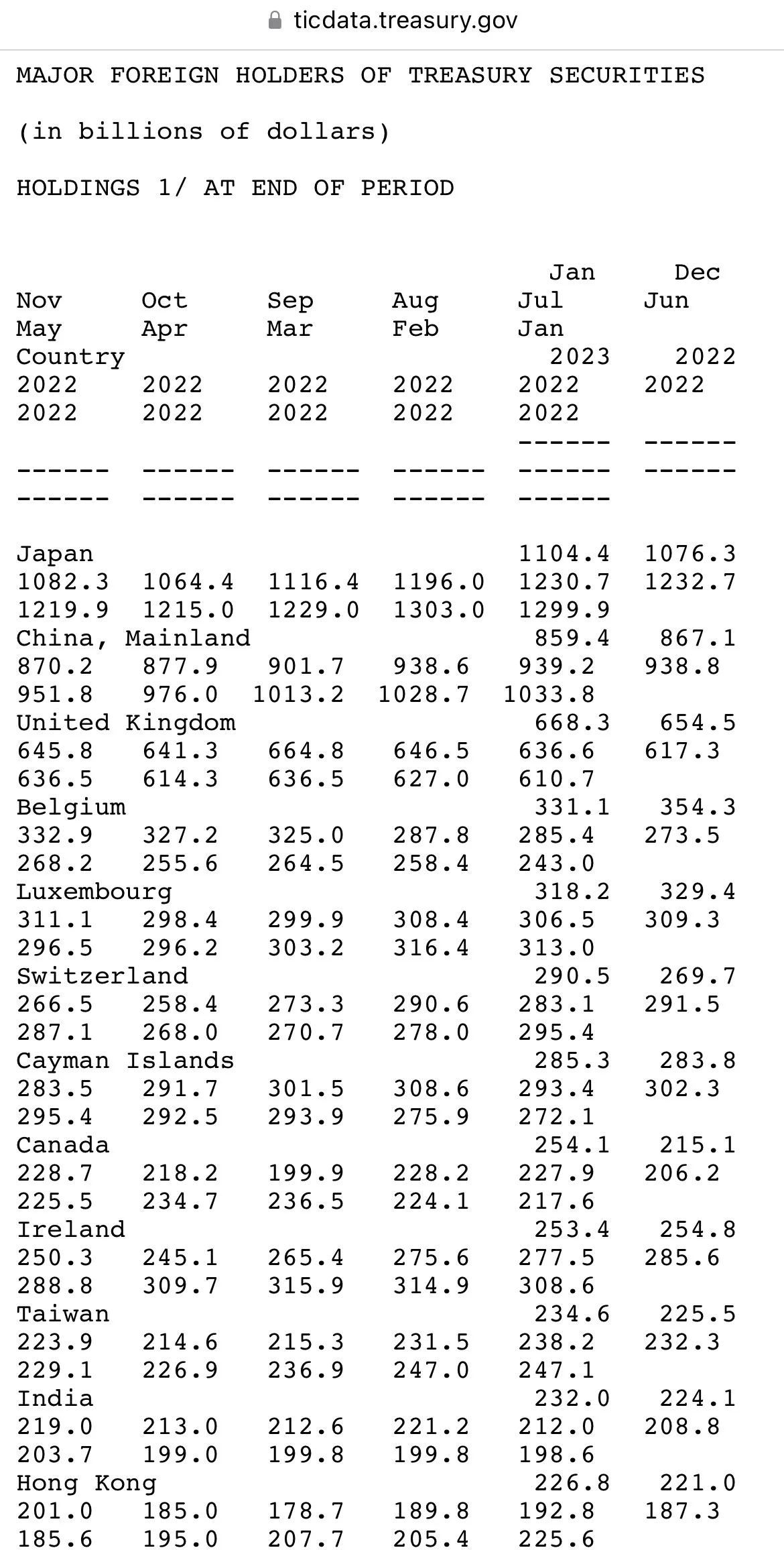

Too bad that the FDIC doesn’t have enough money to bail everyone out.[12]

Citizens Bank, out of Sac City, Iowa was about to default on November 3, so the Federal Deposit and Insurance Company (FDIC) helped the Iowa Trust & Savings Bank bail them out. That same day, depositors couldn’t deposit money into Bank of America, US Bank, Chase Bank, Wells Fargo, and Truist Bank. They, therefore, can’t use that money. Considering the bank bailouts earlier in the year, is the banking system walking into a bank run?

[1]https://www.fdic.gov/news/press-releases/2023/pr23091.html

[2]https://www.youtube.com/watch?v=asS13iqG-Pk

[4]https://www.mirror.co.uk/news/us-news/breaking-bank-america-chase-us-31355733

[5]https://finance.yahoo.com/news/deposit-delays-fed-tells-banks-145821169.html

[6]https://www.hamiltonmobley.com/blog/binance-fast-money-loses-swift

[7]https://www.hamiltonmobley.com/blog/silicon-valley-bank

[8]https://www.hamiltonmobley.com/blog/bank-bailouts

[9]https://www.hamiltonmobley.com/blog/well-this-wont-stop-bank-runs

[10]https://www.hamiltonmobley.com/blog/first-republic-goes-bust

[11]https://www.hamiltonmobley.com/blog/z52xy5bo0on7h93qzai1i449bk8h3v

[12]https://www.hamiltonmobley.com/blog/botkp3i2gi57mqz9ohbt3gwdzyilt6