Turning Points

The Japanese Yen, the Treasury, and the Fed, are all indicating that everything is about to get more expensive in America (inflation). A turning point will come when enough people figure that out and dump their dollars for anything else. Then, we’ll have hyperinflation.

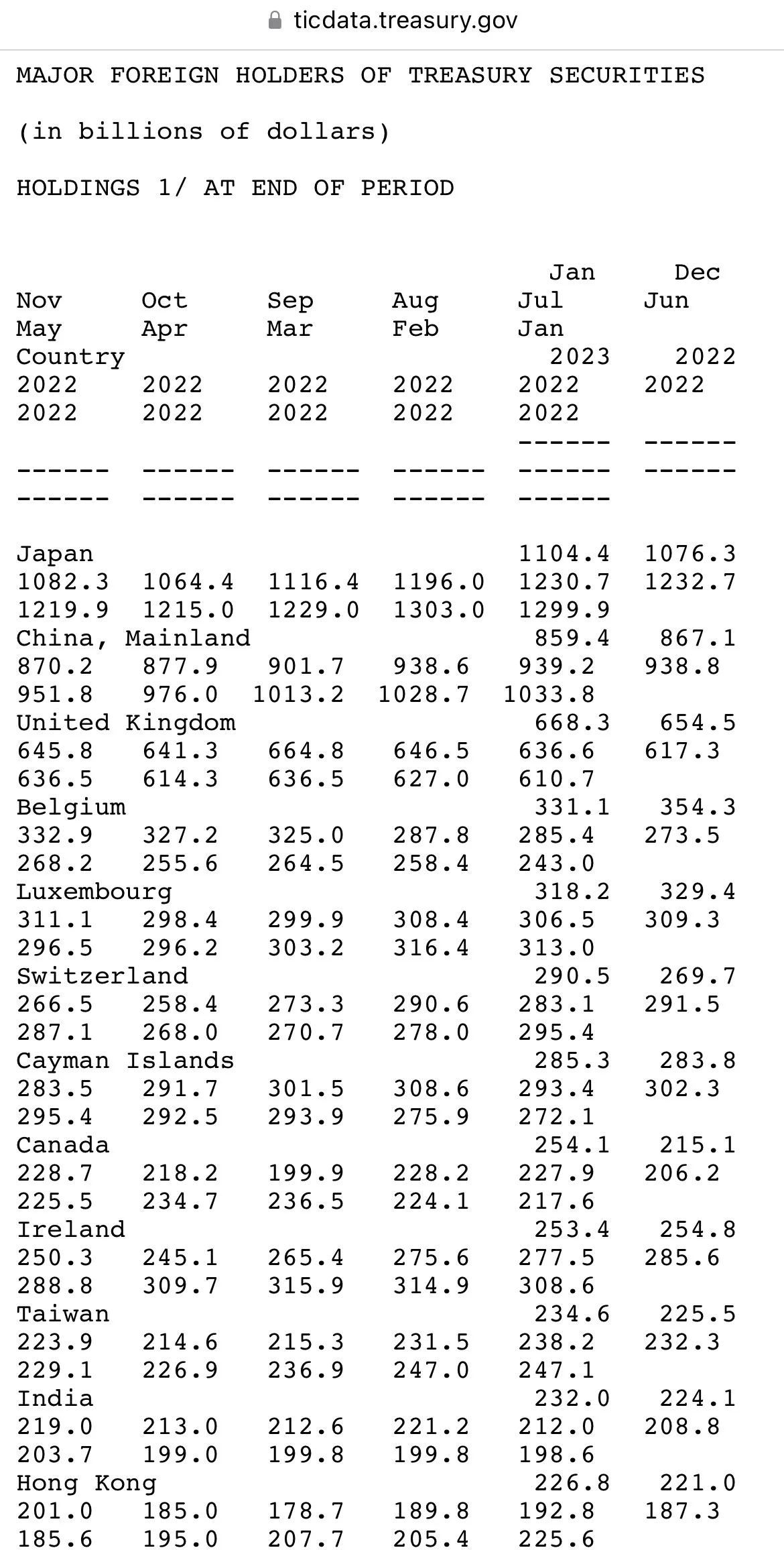

The Yen is weakening as the BOJ prints money to buy everything, so the Japanese could sell much of the, as of January 2023, $1.104 trillion US government bonds that they own to strengthen the Yen, the Treasury is selling $1.5 trillion US government bonds to finance the Anglo-American Empire over the next half year, and the Fed is supposedly raising interest rates… by selling US government bonds. If the Fed doesn’t act as the lender of last resort, then who will finance the US government and economy?

It currently costs ¥151 to get $1. The dollar almost cost ¥150 in October of last year and hasn’t been ¥150 since 1990. It was ¥131 in November 2022 after trading in a ¥98 to ¥123 range from 2013 until March 2022. So, the Yen is worth less versus the dollar, and appears to be going down.

Additionally, the Bank of Japan (BOJ) recently announced that they wouldn’t print so much Yen to keep interest rates low, particularly the 10 year Japanese government debt at sub 1%. This means that the BOJ is likely worried about the declining value of the Yen, which means that they could sell the US government debt that they own to strengthen the Yen by weakening the dollar. It works by the BOJ selling US government debt for dollars in the market (internet), and then use the dollars to buy Yen in the market, until all the worried people wanting Yen for more than ¥150 have been bought out, and the only people left aren’t worried about the Yen becoming worthless.[1]

This is a problem for the US government because they are trying to sell $779 billion of US debt in the final quarter end of the year and an $816 billion for the first quarter of 2024. If the Treasury is selling US government debt and the Japanese are too, and, because the US are the most indebted people in the history of the world at $33 trillion, the world is flush in US debt, then the US may not find enough people to finance our spending and the Japanese may have to sell their US government bonds at a lower price to find enough people in the world who don’t own our debt. The US bond selloff could tank the dollar vs other currencies, even possibly strengthening the Yen. That would mean that Japan would have to sell their US gov bonds for even less…[2]

Luckily for the Treasury and the Japanese, the US central bank, the Federal Reserve (Fed), is the lender of last resort. They could always step in to inflate the money supply and buy US government debt at a low interest rate for the Treasury and on par from the Japanese.[3]

Indeed, tomorrow, November 1, 2023 is the date that the Federal Reserve’s Federal Open Market Committee (FOMC) announces the level that they are setting the Federal Funds Rate, the interest rate that determines all other interest rates in the world. They do this by buying and selling US government bonds. However, Federal Reserve Chairman Jerome Powell has been saying that the economy is great but that he should reduce inflation, so the Fed has been raising rates since February 2022 and tamping down on inflation (liquidity) by selling the US government bonds that they already own.[4]

From the Fed’s own educational website, fred.stlouisfed.org,[5]

“The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity.”

So, if the Fed is selling US debt to raise interest rates, then who is buying what the Treasury and Japanese are selling? It sure aint the Chinese, because they’ve been selling debt and buying gold as their economy crashes too.[6][7]

The Fed is stuck between a rock and a hard place. Either the Fed acts as the lender of last resort and the dollar becomes worth less and worthless, or the Fed stops printing money, raises interest rates, dries up the supply of affordable loans, and causes defaults on a record scale.

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.” -Jerome Powell, Chairman of the Federal Reserve, then member of the Board of Governors, Oct 2012 Federal Open Market Committee Meeting.

So, the Fed will eventually print money to buy US bonds, whether that is the FOMC announcement tomorrow, the next time, or in between.

“But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against ‘real’ goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.” -Ludwig von Mises, Human Action (1949), page 428.

It will kill the dollar and the economy, but so will doing nothing, and nothing is dangerous.

“The U.S. has always paid its bills on time, but the overwhelming consensus among economists and Treasury officials of both parties is that failing to raise the debt limit would produce widespread economic catastrophe. In a matter of days, millions of Americans could be strapped for cash. We could see indefinite delays in critical payments. Nearly 50 million seniors could stop receiving Social Security checks for a time. Troops could go unpaid. Millions of families who rely on the monthly child tax credit could see delays. America, in short, would default on its obligations.” -US Treasury Secretary Janet Yellen, former chairman of the Fed (2014-2018), in opinion piece written for the Wall Street Journal, Sept 19, 2021

Doing nothing is especially dangerous for those held responsible for bursting bubbles, if the history of the South Sea Bubble of 1720 is any indicator.

“As never nation was more abused than ours has been of late by the dirty race of money-changers; so never nation could with a better grace, with more justice, or greater security, take its full vengeance, than ours can, upon its detested foes. Sometimes the greatness and popularity of the offenders make strict justice unadvisable, because unsafe; but here it is not so, you may, at present, load every gallows in England with directors and stock-jobbers, without the assistance of a sheriff’s guard, or so much as a sigh from an old woman, though accustom’d perhaps to shed tears at the untimely demise of a common felon or murderer. A thousand stock-jobbers, well trussed up, besides the diverting sight, would be a cheap sacrifice to the Manes of trade.” Cato’s second letter, The Fatal Effects Of The South-Sea Scheme, And The Necessity Of Punishing The Directors, published on November 12, 1720

The Japanese Yen, the Treasury, and the Fed, are all indicating that everything is about to get more expensive in America (inflation). A turning point will come when enough people figure that out and dump their dollars for anything else. Then, we’ll have hyperinflation.