BIS CBDC

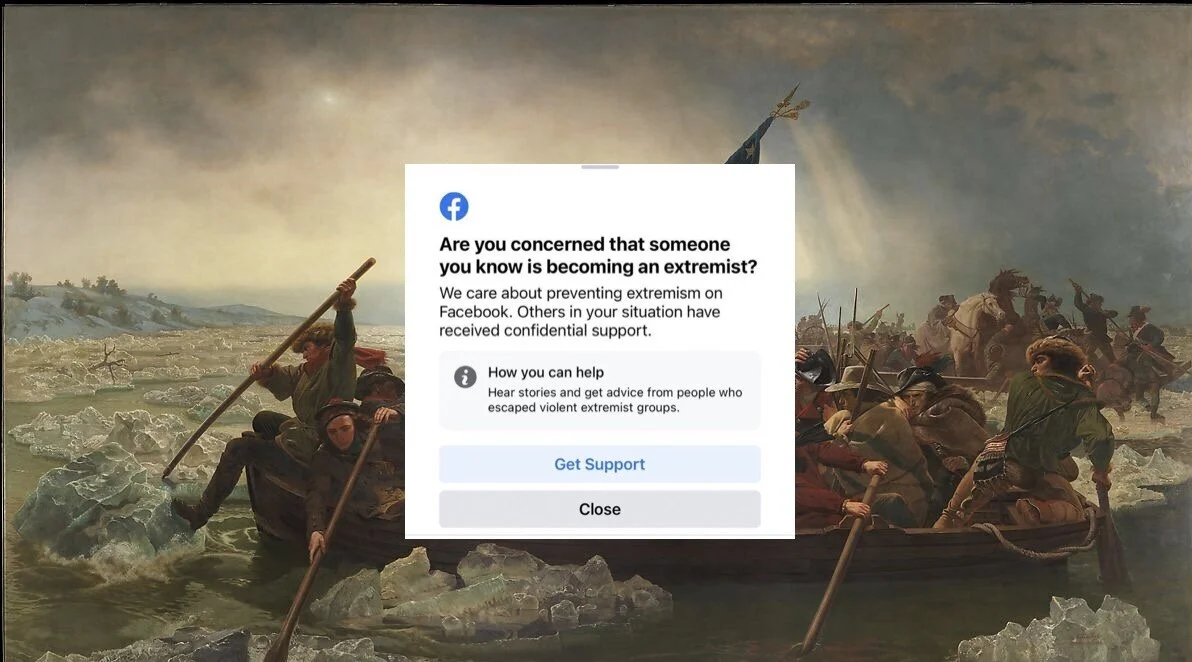

The Bank for International Settlements (BIS) has come out in support of Central Bank Digital Currencies (CBDC).[1][2][3]

The BIS is the central bank of central banks. They adopt the rules by which banks do business.

CBDCs are really just credit exchanged on the internet. It is just like using a debit or credit card, but it would be a new currency most likely not tied to the debt and inflation. It wouldn’t be physical.

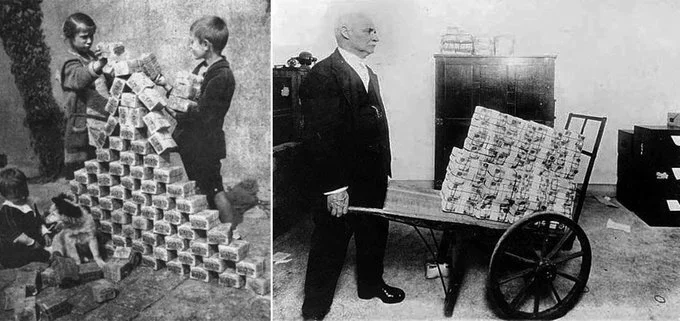

History repeats.

In Nov 1923, Rudolf Havenstein, President of the German Reichsbank, died after printing a historic amount paper marks. His successor, Hjalmar Schacht, stopped printing and Germany replaced the paper mark with the rentenmark and then the gold backed Reichsmark in August 20, 1924.[4]

In a Forbes article entitled, In Hyperinflation's Aftermath, How Germany Went Back to Gold, an unnamed author notes,[5]

“Hyperinflation reached its ultimate end. Farmers refused to take any form of paper money for their crops. The harvest of 1923 sat in farmers’ warehouses while supermarkets in the cities were empty. Starvation and civil unrest loomed.

[…]

On Nov. 13, Schacht was appointed Commissioner for National Currency. On Nov. 15, printing of the devalued mark ceased. On Nov. 16, the very first rentenmarks, linked to gold at the prewar parity, began to emerge. On Nov. 20, the devalued mark was pegged to the rentenmark at a trillion to one. The hyperinflation was over, and Germany was back on a gold standard system.

The Rentenbank apparently held no gold bullion. Instead, the bank held mostly debt, in the form of mortgages on property and bonds on German industry. The rentenmark was not redeemable in gold.

[…]

Farmers accepted the rentenmark in trade for their crop, and the crisis was resolved. A new reichsmark replaced the rentenmark a year later, at 1:1, putting Germany’s return to a gold standard on a more long-term basis.”

Is this somehow connected to Basel III gold regulations going into effect in the European Union on June 28, 2021?[6][7]

Considering how much gold central banks own, why else would central banks be willing to kill their own currencies?

Gold is money by default. History repeats.

[1]https://www.reuters.com/business/central-bank-digital-currencies-get-full-bis-backing-2021-06-23/

[2]https://cointelegraph.com/news/bis-optimistic-about-central-bank-digital-currencies

[3]https://www.bis.org/publ/arpdf/ar2021e3.pdf Page 54- 57.

[4https://www.hamiltonmobley.com/blog/weimar

[5]]https://www.forbes.com/2011/06/09/germany-gold-standard.html?sh=540a15a85934

[6]https://www.bis.org/bcbs/publ/d506.pdf

[7]https://www.hamiltonmobley.com/blog/basel-iii-banking-regulations