More Than Transitory

There are more signs that inflation in the economy is more than transitory as evidenced by Deutsche Bank, the May Consumer Price Index (CPI), and the historic number of reverse repos.

On June 7, Deutsche Bank put out a report from David Folkerts-Landau, Ph.D. Group Chief Economist, Peter Hooper, Ph.D. Global Head of Economic Research, Jim Reid Head of Thematic Research, and Luke Templeman, CPA Research Analyst, stating in the introduction,[1]

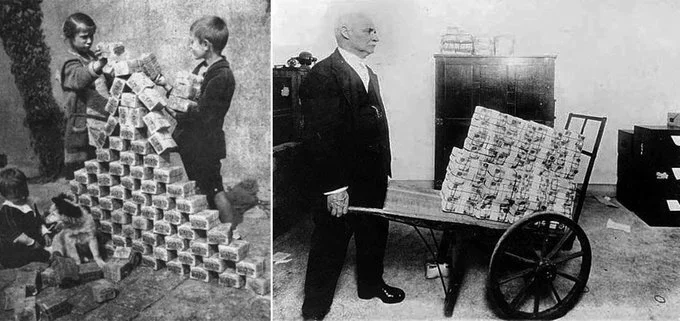

“Today’s paper entitled, “Inflation: The defining macro story of this decade” notes the very role of government in the economy is undergoing its biggest shift in 40 years manifested in the receding fear of inflation and rising levels of government debt that shaped a generation of policymakers. Replacing it is the perspective that economic policy should now prioritise broader social goals.

At its heart the research report debates whether inflation is transitory or the pursuit of these important social priorities by governments will mean inflation will have longer-term and far reaching implications for the health of the global economy. Either way, higher inflation is coming and policymakers are about to face their toughest battle in 40 years.”

The PDF link to the actual paper is not working at present.

The May CPI number also came out. CPI is the establishment manipulated metric for price inflation. It discounts energy and food (because who pays for gas and lunch?) and is meant to keep inflation fears subdued. CNBC gets to the point with the title of one of their online articles, Consumer prices jump 5% in May, fastest pace since the summer of 2008.[2]

The author of the article, Jeff Fox, notes,

“The reading represented the biggest CPI gain since the 5.3% increase in August 2008, just before the financial crisis sent the U.S. spiraling into the worst recession since the Great Depression.”

Finally, the reverse repo volume had spiked to an unprecedented half a trillion dollars. Reverse repos are where the Federal Reserve uses US government bonds that they own as collateral to take an overnight loan from big banks. The next day, they pay off the loan with interest and get the US government bonds back. They are doing this to keep big banks from spiking prices by otherwise spending their money (gotten by selling the government bonds to the Federal Reserve for newly printed money in the first place) in the general economy.[3][4][5]

For comparison, the overnight reverse repo operation has only been used overnight since 2013 and was rarely used in the years prior. It spiking is not a transitory sign for inflation.[6]

There are more signs that inflation in the economy is more than transitory as evidenced by Deutsche Bank, the May Consumer Price Index (CPI), and the historic number of reverse repos.

[2]https://www.cnbc.com/2021/06/10/cpi-may-2021.html

[3]https://apps.newyorkfed.org/markets/autorates/temp

“In a repo transaction, the Desk purchases Treasury, agency debt, or agency mortgage-backed securities (MBS) from a counterparty subject to an agreement to resell the securities at a later date. It is economically similar to a loan collateralized by securities having a value higher than the loan to protect the Desk against market and credit risk. Repo transactions temporarily increase the quantity of reserve balances in the banking system.

In a reverse repo transaction, the opposite occurs: the Desk sells securities to a counterparty subject to an agreement to repurchase the securities at a later date at a higher repurchase price. Reverse repo transactions temporarily reduce the quantity of reserve balances in the banking system.”