First Republic Goes Bust

First Republic Bank was bailed out by the FDIC (backed by the Federal Reserve) and bought by JP Morgan. Treasury Secretary Janet Yellen said that the USA would default June 1 if the USA do not add more to the federal debt. Federal Reserve Chairman Jerome Powell is suppressing interest rates from rising to their free market levels on Wednesday. Will the Fed keep printing money to bail out the banks and the government?

First Republic Bank is the second largest bank failure in US history, taking the spot from Silicon Valley Bank which only just took the spot in March.[1]

The FDIC put out a press release today, Monday, May 1, 2023,[2]

“WASHINGTON — First Republic Bank, San Francisco, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC is entering into a purchase and assumption agreement with JPMorgan Chase Bank, National Association, Columbus, Ohio, to assume all of the deposits and substantially all of the assets of First Republic Bank.”

Zerohedge has an interesting note,[3]

“After another massive bank failure - and taxpayer-funded bailout - JPMorgan CEO Jamie Dimon told listeners on an investor call this morning that ‘The system is very, very sound.’

Doesn't seem like it Jamie, old chap?

But hey, whatever you say now as the CEO of a bank that holds over 10% of America's deposits.”

Also today, former Chairwoman of the Federal Reserve from 2014 to 2018, Janet Yellen, said that the USA would default as soon June 1. In an official letter from the Department of the Treasury addressed to “The Honorable Kevin McCarthy Speaker U.S. House of Representatives,” US Treasury Secretary Yellen wrote,[4]

“In my January 13 letter, I noted that it was unlikely that cash and extraordinary measures would be exhausted before early June. After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government's obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time.”

Federal Reserve Chairman Jerome Powell is announcing how the central bank will control interest rates by setting the Federal Funds Rate on Wednesday. Short story, the Fed suppresses interest rates by printing money and buying US government bonds. They make it sound fancy to be confusing.[5]

Will the Fed keep printing money to bail out the banks and the government? Jerome Powell could stop printing money, let the banks fail, not lend to the government, and let interest rates rise to their free market levels, but that would result in a crushing depression and and social unrest.

“The U.S. has always paid its bills on time, but the overwhelming consensus among economists and Treasury officials of both parties is that failing to raise the debt limit would produce widespread economic catastrophe. In a matter of days, millions of Americans could be strapped for cash. We could see indefinite delays in critical payments. Nearly 50 million seniors could stop receiving Social Security checks for a time. Troops could go unpaid. Millions of families who rely on the monthly child tax credit could see delays. America, in short, would default on its obligations.” -US Treasury Secretary Janet Yellen, former chairman of the Fed (2014-2018), in opinion piece written for the Wall Street Journal, Sept 19, 2021

The Fed will print money or it all crashes. Luckily, on March 12, Powell and Yellen both promised that the Fed and the Treasury would backstop the banks. The Democrats and Republicans will find a bipartisan way to add to the debt.[6]

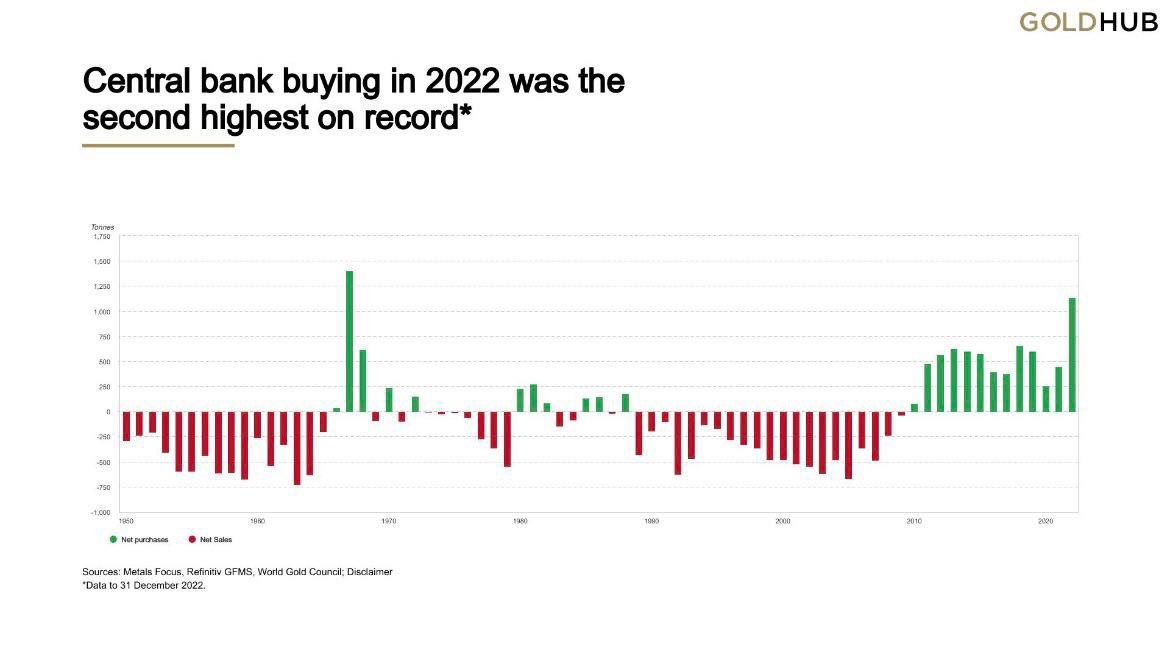

Nothing was fixed in 2008. Central banks just printed money for over a decade to kick the can down the road and buy gold.

“But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against ‘real’ goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.” -Ludwig von Mises, Human Action (1949), page 428.

First Republic Bank was bailed out by the FDIC (backed by the Federal Reserve) and bought by JP Morgan. Treasury Secretary Janet Yellen said that the USA would default on June the first if the USA do not add more to the federal debt. Federal Reserve Chairman Jerome Powell is suppressing interest rates from rising to their free market levels on Wednesday. It seems like everyone needs money.

[2]https://www.fdic.gov/news/press-releases/2023/pr23034.html

[4]https://home.treasury.gov/system/files/136/Debt_Limit_Letter_Congress_Members_05012023.pdf

[5]https://www.hamiltonmobley.com/blog/printing-money-lowers-interest-rates