Helicopter Money

Steve Mnuchin has reportedly confirmed that the US government will start handing out money to Americans.[1]

Via Carl Quintanilla of CNBC’s twitter account,

“‘We are looking at sending checks to Americans IMMEDIATELY. .. Now, and I mean now. In the next two weeks.’ - Mnuchin, at briefing”[2]

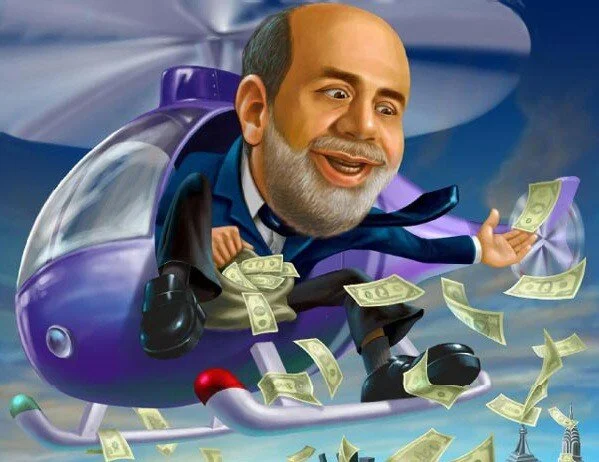

The term “helicopter money,” comes from the economist Milton Friedman via a 2002 speech given by future Federal Reserve Chairman Ben Bernanke (2006-2014).

He said,

“Each of the policy options I have discussed so far involves the Fed's acting on its own. In practice, the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities. A broad-based tax cut, for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices. Even if households decided not to increase consumption but instead re-balanced their portfolios by using their extra cash to acquire real and financial assets, the resulting increase in asset values would lower the cost of capital and improve the balance sheet positions of potential borrowers. A money-financed tax cut is essentially equivalent to Milton Friedman's famous "helicopter drop" of money.

Of course, in lieu of tax cuts or increases in transfers the government could increase spending on current goods and services or even acquire existing real or financial assets. If the Treasury issued debt to purchase private assets and the Fed then purchased an equal amount of Treasury debt with newly created money, the whole operation would be the economic equivalent of direct open-market operations in private assets.”[3]

The Fed is already buying treasuries and both they and the US government are bailing out everyone.[4][5][6]

In his speech, Bernanke concluded,

“Nevertheless, I hope to have persuaded you that the Federal Reserve and other economic policymakers would be far from helpless in the face of deflation, even should the federal funds rate hit its zero bound.”

The Federal Funds Rate hit the zero bound interest rate on Sunday.[7] We have liftoff.

[2]https://mobile.twitter.com/carlquintanilla/status/1239943972073746435

[3]https://www.federalreserve.gov/boarddocs/speeches/2002/20021121/

[4]https://www.hamiltonmobley.com/blog/5zs9y5c9h9swjmer70vp6emq9n0pc9

[5]https://www.hamiltonmobley.com/blog/g16m2k3xa0ggswu0bxcruvubfvxhme

[6]https://www.hamiltonmobley.com/blog/jz1r0lnt7llgptm0p7hcdwss56nwu5

[7]https://www.hamiltonmobley.com/blog/8yx2e042u67urf9361f5k8slo25rrs