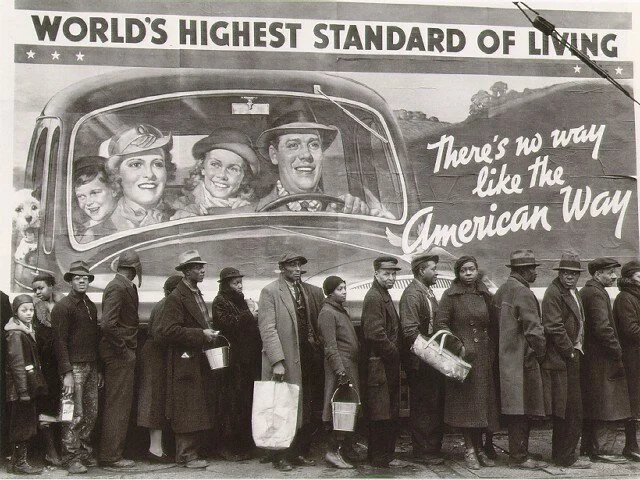

The Cure Is Worse Than the Disease

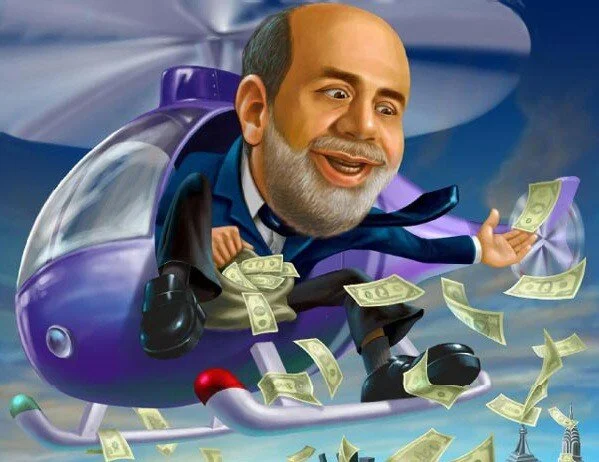

The Fed is printing money to save the economy from a recession. The cure could be worse than the disease.

The largest manufacturer in America, Boeing, is considering layoffs.[1] Bank of America think that we are already in a recession and Federal Reserve Bank of Saint Louis President James Bullard thinks that unemployment could hit 30%.[2][3]

Therefore, the Fed is bailing out municipalities and is buying mortgage backed securities with at least $4 trillion ready to lend (out of thin air).[4][5][6]

Oliver Harvey at Deutsche Bank thinks that one should hedge against inflation.

“ We are worried that the real pain trade for markets – and the economy – is the long awaited return of inflation.

A good hedge would be to buy gold, as well as inflation linked bonds in the US and Euro Area, which are currently trading at all time lows.”[7]

At best, stocks will be inflated along with everything else- defeating the purpose and killing the dollar.

Weimar, here we come![8]

[1]https://www.wsj.com/amp/articles/boeing-considers-dividend-cut-layoffs-amid-cash-drain-11584637183

[5]https://www.newyorkfed.org/markets/opolicy/operating_policy_200319a

[8]https://www.hamiltonmobley.com/blog/inflationary-stock-market-recessions