J Powell’s, G Sachs’s, the ECB’s, and Moody’s Blues.

J Powell’s, G Sachs’s, the ECB’s, and Moody’s Blues.

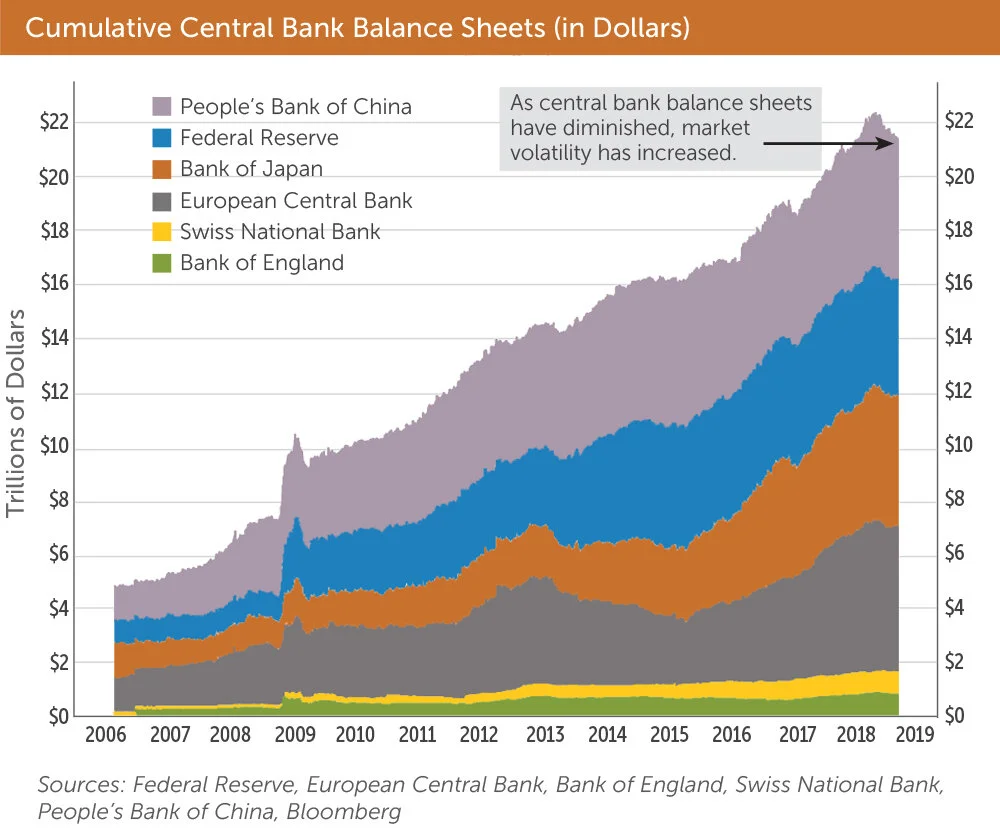

Goldman Sachs, the Federal Reserve, Moody’s rating agency, and the European Central Bank (ECB) are all warning about the risks of low interest rates. Low interest rates are being caused by central banks printing money.

Goldman Sachs’s Chief Economist, Jan Hatzius, opined in his Global Economics Report this week,

“With S&P 500 earnings on track for roughly zero growth from this time last year, solid returns likely would not have been possible without central bank support.”[1]

Speaking before Congress’ Joint Economic Committee on Nov 13, Federal Reserve Chairman Jerome Powell said,

“The debt is growing faster than the economy- that’s unsustainable. It’s not the Fed’s job to say how the government should cut the deficit, but we need to get the economy to grow faster than the debt. Otherwise, future generations will be paying more of their taxes to cover the government’s debt costs than for other things like health care, etc.

I think the new normal now is low interest rates, low inflation and probably lower growth. Even with the lower interest on its debt, the government still needs to reduce its budget deficit.” [2]

The government is able to run a deficit because the Fed is printing the money to buy the bonds and lower interest rates- making the debt more affordable than it would otherwise be.

Following that train of thought, Moody’s rating agency has downgraded the German banking system’s outlook to negative because of low interest rates. Elliot Smith of CNBC writes,[3]

“‘Traditional commercial banks and in particular deposit-funded institutions will struggle to out-earn their costs in the continuing low interest rate environment, even though loan-loss provisions are unsustainably low,’ said Bernhard Held, Moody’s vice-president and senior credit officer.”

Silvia Amaro of CNBC states that Luis de Guindos, Vice President of the ECB, believes that low interest rates are increasing the risks that investors are taking to make profits.[4]

“‘This low interest rate environment also affects the investment strategy of the asset managers and in this respect this part of the financial system could give rise to bigger risks,’ he said.

According to the central bank, institutions such as investment funds and insurance companies have been more risk-taking in the current low interest rate environment. This means that in case of a sudden market shock, for instance, stress among these institutions could spread to the wider financial system- leading to losses for companies and individuals.

The ECB also cited in its financial stability report risks in the property market. Riskier firms are taking on more borrowing and property prices continue to rise in ‘a number’ of euro area countries.”

The theme is that printing money and lowering interest rates creates bubbles. The economist Ludwig von Mises predicted the outcome of printing money on page 570 of his 1949 magnus opus, Human Action.[5]

“The wavelike movement affecting the economic system, the recurrence of periods of boom which are followed by periods of depression, is the unavoidable outcome of the attempts, repeated again and again, to lower the gross market rate of interest by means of credit expansion. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

[1] https://www.zerohedge.com/economics/powells-fantasy-economy-should-grow-faster-debt

[2] https://www.cnbc.com/video/2019/11/13/feds-powell-debt-is-growing-fast-than-economy-and-thats-not-sustainable.html