JP Morgan: Money is Gold and Nothing Else

The bank JP Morgan dominates and manipulates the gold and silver market.

Peter Hobson of Reuters writes,[1]

“JPMorgan has earned record revenue of around $1 billion so far this year from trading, storing and financing precious metals, vastly outperforming rival banks, two sources familiar with the matter told Reuters.

[…]

It sits at the heart of the global bullion market, and its activities span trading physical bars to derivatives, running vaults and clearing trades in London, the biggest trade hub.”

JP Morgan settled charges of rigging the gold and silver market this year in September.

According to Hugh Son writing for CNBC,[2]

“J.P. Morgan Chase has quietly settled a long-running lawsuit that accused the bank of manipulating precious metals markets with ‘spoofing’ trades.

And the bank is set to pay $920 million to resolve government investigations for similar alleged conduct in the precious metals and Treasury futures markets, CNBC has learned.”

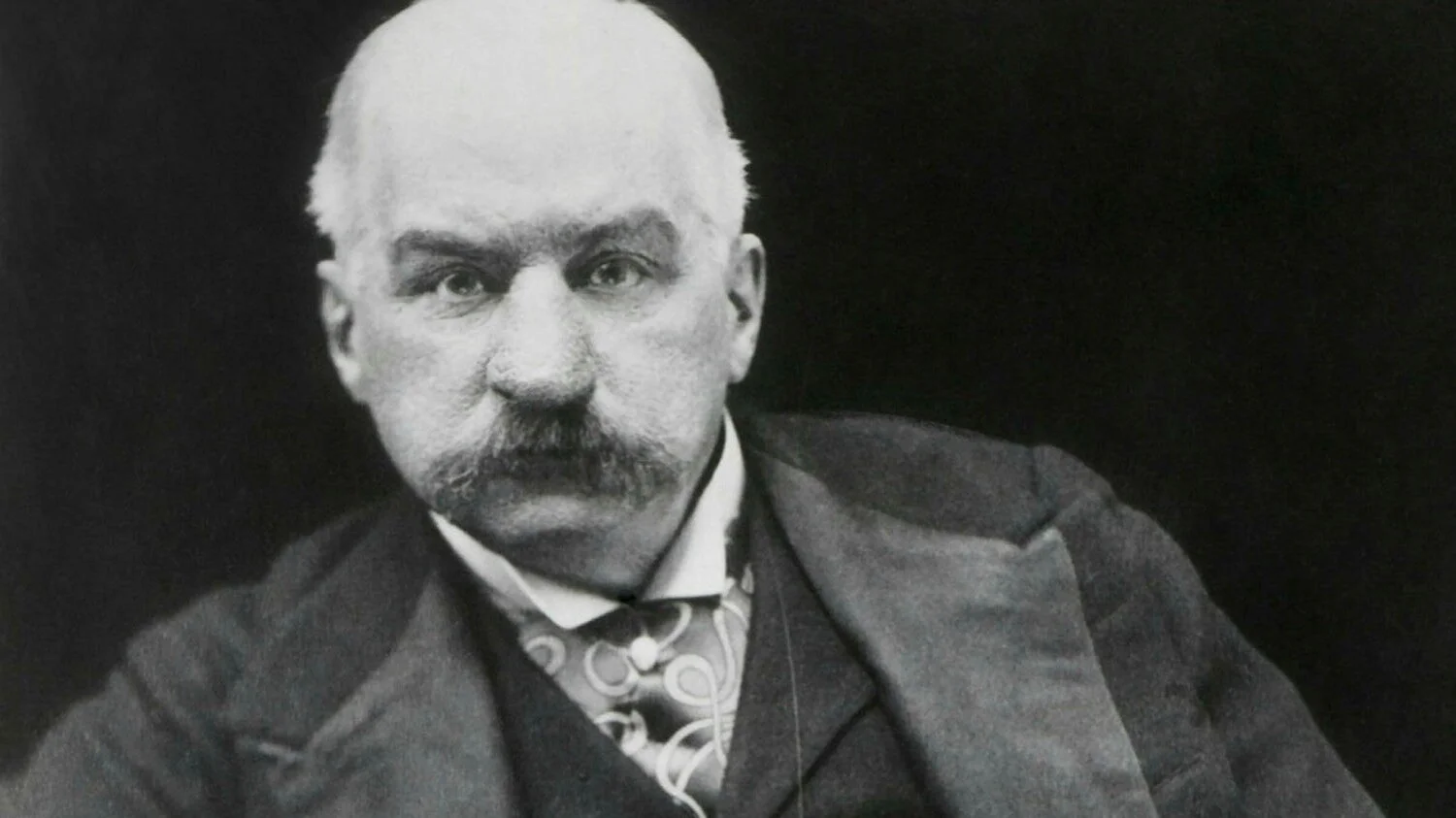

Indeed, JP Morgan has been interested in gold since John Pierpont (JP) Morgan was still alive. JP Morgan testified before the US House of Representatives in 1912- the year before the Federal Reserve was created. He was questioned by attorney Samuel Untermyer on money and banking.[3]

Q. But the basis of banking is credit, is it not?

A. Not always. That is an evidence of banking, but it is not the money itself. Money is gold and nothing else.

The Bank of Italy, officially the worlds 3rd largest owner of gold,[4] published a report as to why gold is money. They wrote,[5]

Incorporating gold into a financial portfolio is a way of hedging against high-risk scenarios, however unlikely. This function has been very much to the fore in recent years: in the face of widespread fears about the resilience of the financial system in 2008-09 and the stability of the euro area in 2011-12, gold performed particularly well, adding considerably to the equity revaluation account in which the Bank records increases in the value of its gold reserves.

Another good reason for holding a large position in gold is as protection against high inflation since gold tends to keep its value over time. Moreover, unlike foreign currencies, gold cannot depreciate or be devalued as a result of a loss of confidence. So, when a foreign exchange crisis erupts, central banks can use gold in the same way as their official foreign exchange reserves, to shore up confidence in the national currency; they do so by using gold as collateral for loans or, as a last resort, selling it to buy national currency and uphold the latter’s value. A large stock of gold gives a central bank plenty of room for manoeuvre to preserve confidence in the national financial system.

Maybe the people in banking know what they are doing.

“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.” -Former Federal Reserve Chairman Alan Greenspan, Meet the Press, August 7, 2011.

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.” -Fed Chairman Alan Greenspan, US Senate Committee on Banking, Housing and Urban Affairs, Feb 16, 2005.

“Gold is a currency. It is still by all evidences the premier currency where no fiat currency, including the dollar, can match it.” - Alan Greenspan, in an interview for the Council on Foreign Relations, Nov 2014

[3]https://memory.loc.gov/service/gdc/scd0001/2006/20060517001te/20060517001te.pdf Page 48.