“We are looking at sending checks to Americans IMMEDIATELY. .. Now, and I mean now. In the next two weeks.” - US Treasury Secretary Steve Mnuchin

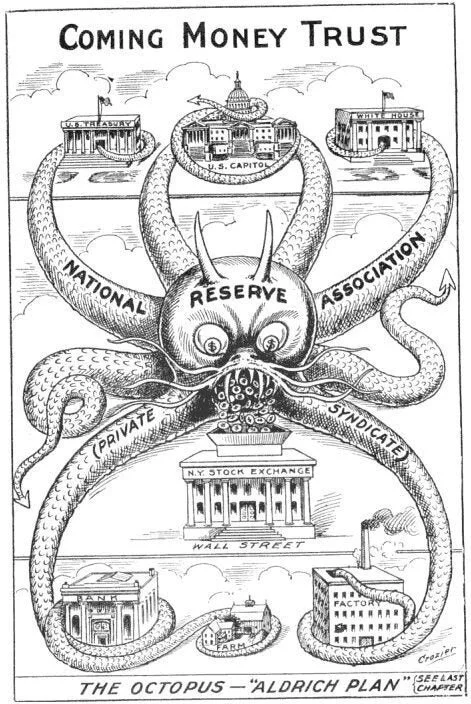

Commercial Paper Funding Facility

The Federal Reserve is printing money to bailout bad car loans, bad mortgages, and insolvent companies.

Mississippi Medical Marijuana

Cannabis is already legal. The police are just not enforcing the law.

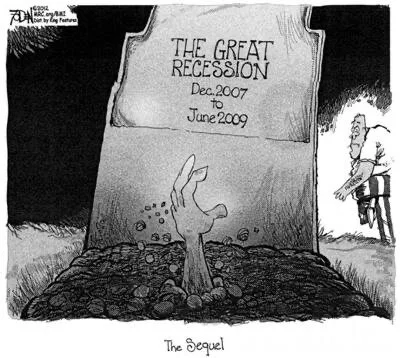

TARP Again

It makes sense considering that less than 50% of Americans have $400 saved for an emergency.

World Wide Low Rates

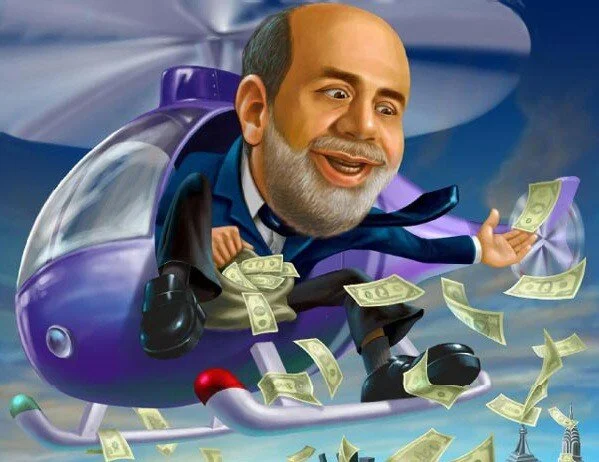

The Fed put out two more announcements in support of QE infinity today.

The End Game

The Federal Reserve has cut interest rates to near 0% and is printing $700 billion over coming months to buy treasuries and mortgages.

QE Infinity

The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York: “The first such purchases will begin tomorrow, March 13, 2020. Today, March 12, 2020, the Desk will offer $500 billion in a three-month repo operation at 1:30 pm ET that will settle on March 13, 2020. Tomorrow, the Desk will further offer $500 billion in a three-month repo operation and $500 billion in a one-month repo operation for same day settlement.”

Limit Down

Oil, Stocks, and Interest Rates are all lower.

Stocks opened up and were stopped out down more than 7% after futures were halted overnight at a loss of 5%.

Historically Low Interest Rates

If you lent money to a country with the most debt in recorded history, would you charge historically low interest rates?

Pump It Up!

“In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent.“ FOMC 3/3/2020

Pumping Money Into the Economy

“Other Central Banks are much more aggressive. The U.S. should have, for all of the right reasons, the lowest Rate.” -President Trump

“We will use our tools and act as appropriate to support the economy.“ -Chairman Powell.

Fear Trades

Fear trades are starting to be profitable. Once bond holders realize that their paper profits will be inflated away by central banks, then gold will see record highs in all currencies.

More Printing

“Putting it in context, the total credit injection of more than 5 trillion yuan, or roughly $725 billion, in one month, was the single biggest on record.”

The Sun is Setting on Japan and India

The world faces a depression.

The Christmas Truce

What if peace had broken out in 1914?

Signaling Tighter Fed Liquidity

“[…] go short credit & stocks when new lows in bond yields & US$ appreciation becomes disorderly bearish signaling tighter Fed liquidity & sparking recession/default fears.”

-Bank of America CIO Michael Hartnett

The Baltic Dry Index and JOLT

The decline in the Baltic Dry Index is matched only by the late 2015- early 2016 plunge. Anyone paying attention back then remembers August as being interesting.

Controlling the Meter

JP Morgan Chase is being investigated for manipulating the precious metals market.

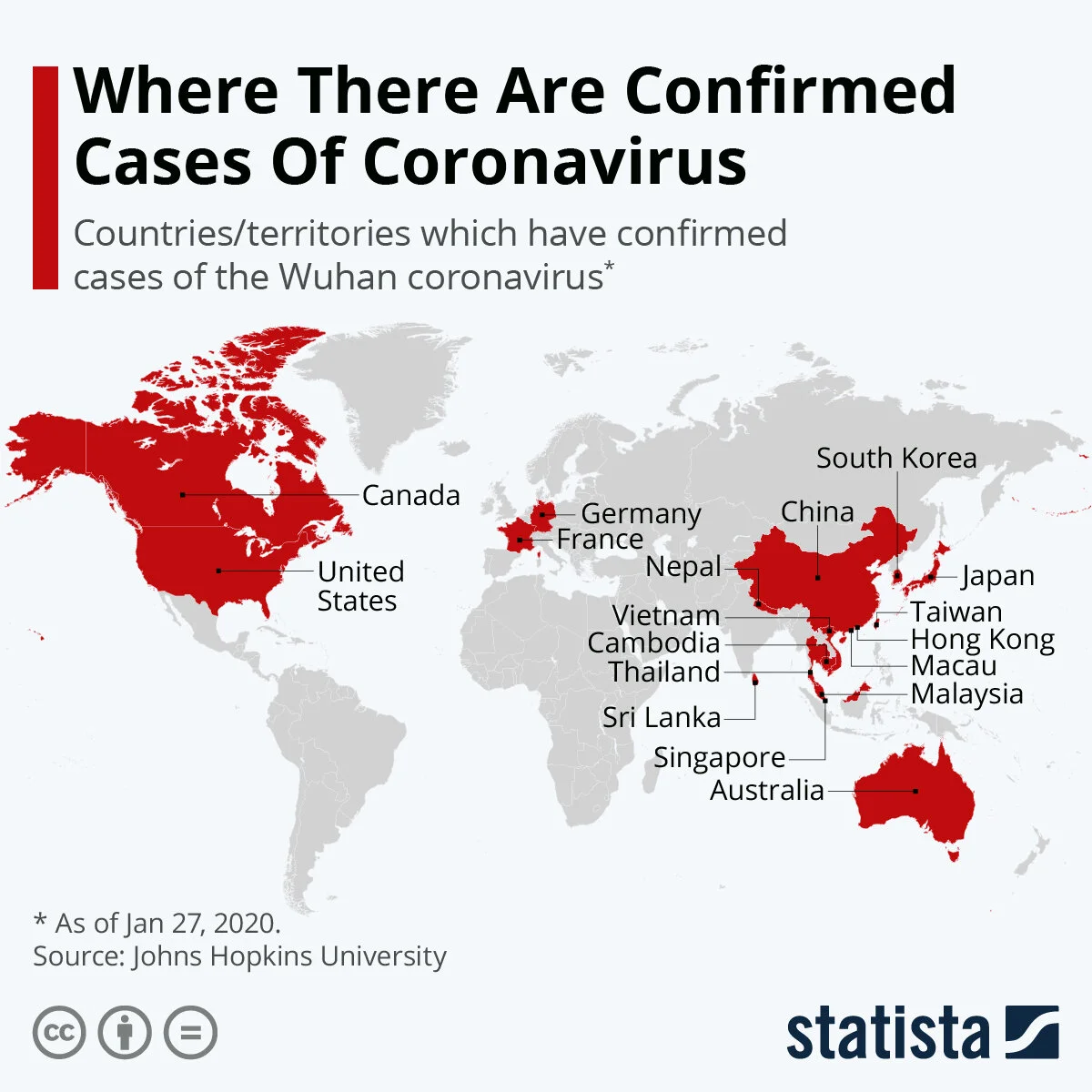

Chinese Fever

If the virus is worse than presently known… Black Swan.

Pandora’s Box

What happens when unlimited demand hits supply constraints?