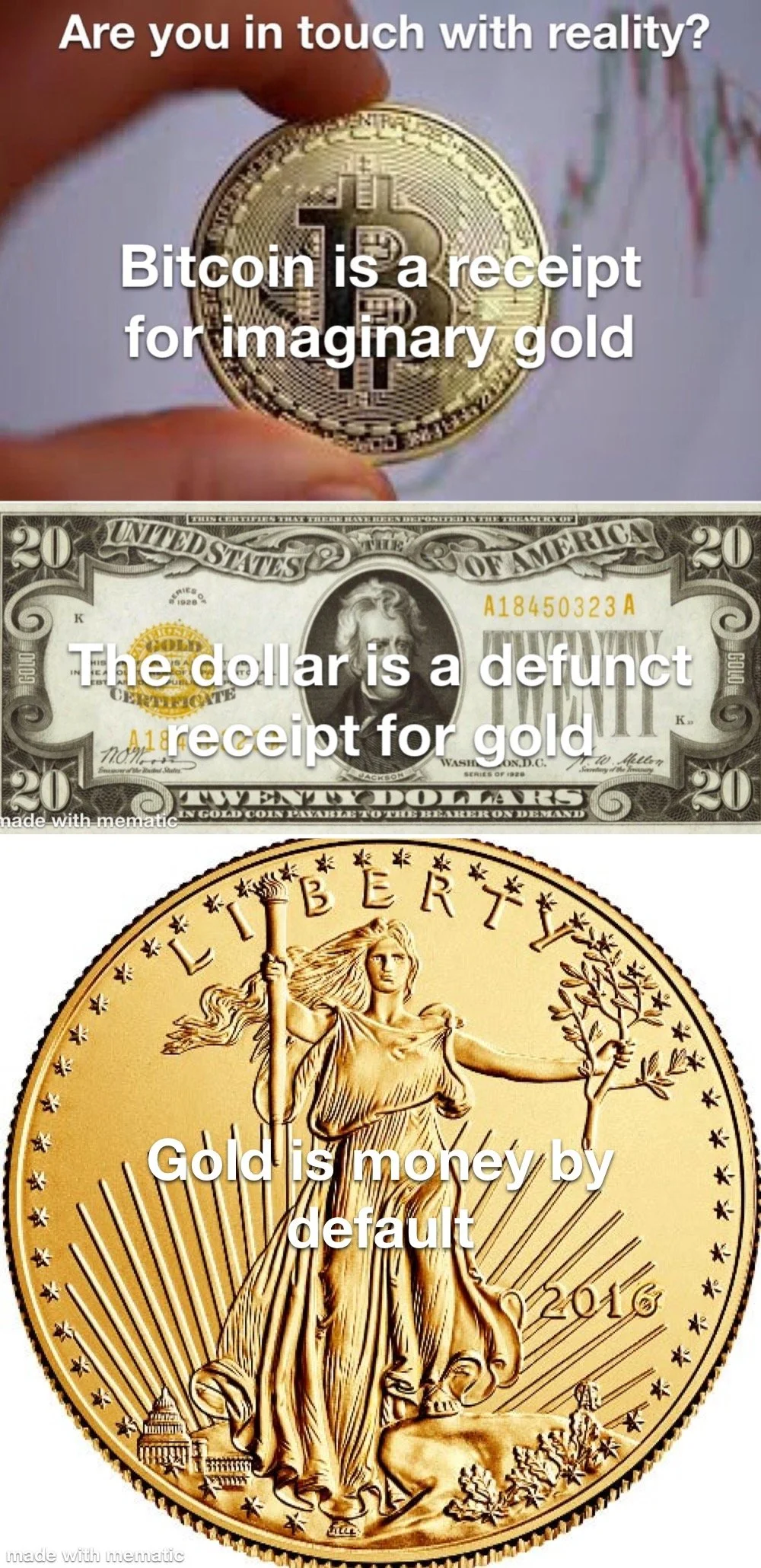

According to dictionary.com, arbitrage is “the simultaneous purchase and sale of the same securities, commodities, or foreign exchange in different markets to profit from unequal prices.” Over the past two weeks, the price of gold in Shanghai, China has been selling at ~$2,000, which is about $100 higher than the spot price at $1,900. This is not common. That means that people could be buying gold in the West and selling it in the East at a profit, moving gold to China. He who has the gold makes the rules. The world speaks English for a reason.

Canadian Politics

The Canadian Parliament, including Prime Minister Justin Trudeau, gave a standing ovation for a Ukrainian member of the Waffen SS, an elite military unit fighting for the NAZIs in World War II, while Jewish Ukrainian President Zelensky visited on Friday, September 22, 2023. Justin Trudeau and his like have been calling Candadians NAZIs for opposing the covid lockdowns. Maxime Bernier, Canadian politician and founder of the People’s Party of Canada had some pointed comments.

Mississippi Politics

Recently, Democratic nominee for the Governor of the great state of Mississippi, Brandon Presley, said that he would get rid of the good ole boys’ club. He may want to check his notes, because Democrats had run the state until a little over a decade ago. They are the good ole boys’ club.

Rich Men North of Richmond

“And they don’t think you know but I know that you do.

Because your dollar aint shit and it’s taxed to no end,

‘Cause of rich men North of Richmond.”

Chinese Shadow Banks

The Chinese shadow banking sector and property market are imploding. Zhongrong missed payments and Evergrande finally declared bankruptcy. Many rich Chinese will seek British tax-havens, which are probably the source of much shadow banking funding. The sun has not yet set on the British Empire.

Blowback (Chinese Tofu Dreg)

Blowback is a term that refers to the negative reaction by people to government policy. For decades, China has been syphoning business from Western countries who were escaping progressively increasing taxes and regulations. This growth legitimized the Chinese Communist Party (CCP) after the failure of the Great Leap Forward. However, this boom is ending, notably with the covid lockdowns, imploding property market, failing banks, and historic floods. As the Chinese people are impoverished, Chinese politicians will experience blowback by losing popularity, which could result in another Chinese warlord period as local officials fill the power vacuum.

What Do Banks Own?

Banks are supposed to have money. Starting in March (a year after the Federal Reserve began raising interest rates), the banks Silicon Valley Bank, Signature Bank, Credit Suisse, and First Republic were bought and bailed out. On July 25, the Banc of California bought out Pacific Western Bank. What do banks own if they need money?

Blowback (Europe)

“When France sneezes, Europe catches a cold.”

-Prince Klemens von Metternich, Austrian foreign minister (1809-1848) and Chancellor (1821-1848). Ousted from power by the Spring Revolutions of 1848.

Blowback (America)

“I believe very sincerely that the CIA is correct when they teach and talk about blowback.” -Ron Paul, Fox Republican Presidential Primary Debate, January 10, 2008.

$32 Trillion Debt

The USA have nearly $32 trillion in debt. The only way to settle the debt is by printing money or by default.. The dollar is being progressively ditched as the world’s reserve currency as its purchasing powers decreases with every dollar printed. Either via inflation or default, the dollar’s days are numbered.

The SEC Goes After Binance and Coinbase

The United States’ Securities and Exchange Commission (SEC) is suing Binance and Coinbase for fraud. Both companies are crypto trading websites, which means that cryptos may lose customers.

Immigration

We fix immigration by requiring anyone wanting to move here to memorize the Bill of Rights and to sign a contract with a citizen who would be liable for their crimes and debts. Apply the 13th Amendment to anyone who stays illegally after a relatively short transition period.

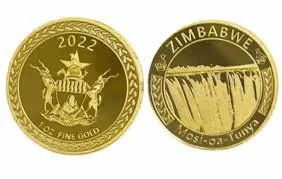

Gold Credit

China and Zimbabwe are both offering bank accounts using gold as money, or, at least, redeemable as gold.

First Republic Goes Bust

First Republic Bank was bailed out by the FDIC (backed by the Federal Reserve) and bought by JP Morgan. Treasury Secretary Janet Yellen said that the USA would default on the first of June if the USA do not add more to the federal debt. Federal Reserve Chairman Jerome Powell is suppressing interest rates from rising to their free market levels on Wednesday.

Red Flag Laws Are Red Coat Laws

On April 19, 2023, the President of the USA and the governor of Tennessee announced that he wanted more gun control laws- either outright confiscating Americans’ weapons or using red flag laws to selectively confiscate weapons. Considering that the battles of Lexington and Concord occurred on April 19, 1775, red flag laws are Red Coat laws.

Bellum Monetariorum (The War of the Moneyers)

"From Aurelian Augustus to Ulpius his father. Just as though it were ordained for me by Fate that all the wars that I wage and all commotions only become more difficult, so also a revolt within the city has stirred up for me a most grievous struggle. For under the leadership of Felicissimus, the lowest of all my slaves, to whom I had committed the care of the privy-purse, the mint-workers have shown the spirit of rebellion.”

-Emperor Aurelian, writing on the Bellum Monetariorum, in either 271 or 274 AD.

CNN and Fox Question the Dollar

Following a meeting between Xi and Putin, CNN and Fox News both put out segments questioning the strength of the dollar as the world’s reserve currency. The news is quickly going mainstream. In a quote popularly attributed to Mark Twain, when asked how he went bankrupt, he responded, “Slowly and then all at once.”

Well, This Won't Stop Bank Runs

On Thursday, March 16, 2023, US Treasury Secretary (and former Charwoman of the Federal Reserve) Janet Yellen testified before the US Senate Finance Committee. Her testimony to Senator Lankford wasn’t confidence boosting.

Bank Bailouts

Credit Suisse is being bailed out by the Swiss National Bank via UBS. Also, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are freaking out.

Silicon Valley Bank and Signature Bank Go Bust

Silicon Valley Bank went bust on Friday, March 10, 2023. On Sunday, Signature Bank was been shut down by regulators. They are the 2nd and 3rd largest bank failures in US history, respectively. This happened because the Federal Reserve (Fed) has been raising interest rates for the past year, drying up the supply of affordable low interest rate loans. The only way for the depositors to be made whole is for the government to bail them out, using the Federal Reserve as the lender of last resort. Soon, everyone will want to be bailed out.