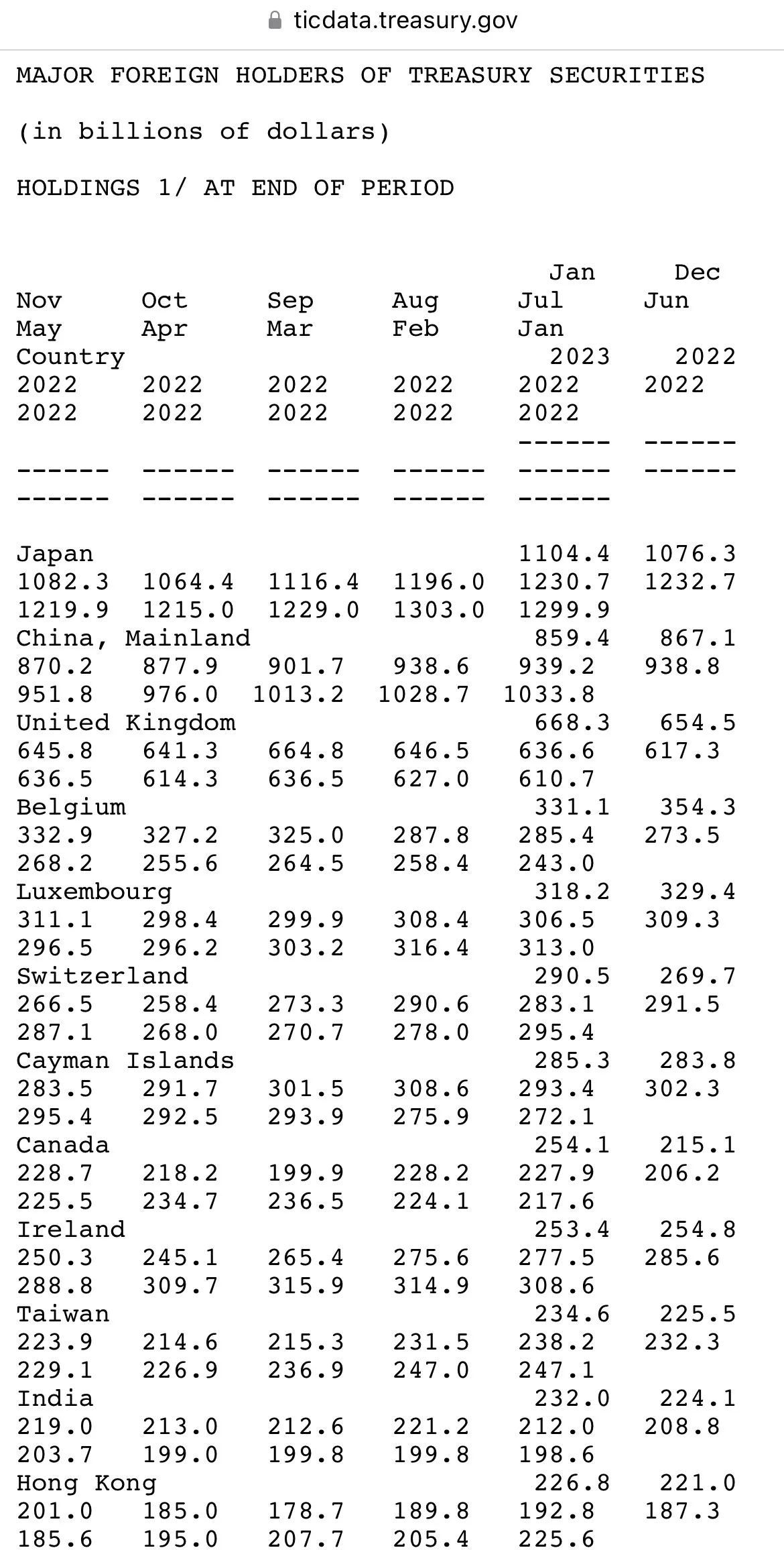

As of yesterday, Wednesday, April 10, 2024, it now takes ¥153 to get $1. The Bank of Japan can strengthen the ¥en by selling US government bonds. They could then sell the dollars that they get from the bonds for ¥en on the open market for less than ¥153. It is a cheap trick, but it will yank around the Federal Reserve, who will need to be the lender of last resort to the US government if Japan and China are selling. That means more inflation for the USA, and a weakening US dollar. Talk about YinYang!

P Diddy Diddle

Who did P Diddy diddle? Who did Diddy do?

Perhaps the blackmail operation tied to Jeffrey Epstein and Ghislaine Maxwell is falling apart.

Depressing News

As of February 15, 2024, Germany, Japan, and the United Kingdom were in a recession. Jamie Dimon is selling shares of JP Morgan and Berkshire Hathaway is holding cash. Druckenmiller is buying gold. The stock price of New York Community Bank fell 60% in the first week of February. They bailed out Signature Bank. With the Bank Term Fuding Program allegedly expiring in March, are we about to be in American recession?

Things Fall Apart II

Food is getting expensive in the European Union. Decades of printing money, raising taxes, and controlling the economy have made everything more expensive. The more money people spend on food, the less they can spend on consumption and investment. European farmers themselves are facing higher prices, and have spontaneously united across Europe to protest their impoverishment by the government. They have even potentially inspired more trucker protests in Canada. They’d be happening in China too, but they have less freedom. Revolutions find fertile ground in hungry bellies and empty pockets.

Jan 6 Entrapment

Steven D’Antuono was the head of the Detroit FBI’s field office in 2020 when the Michigan State Capital building was stormed by protestors and when the FBI foiled a plot to kidnap Michigan Democratic Governor Gretchen Whitmer. He was then transferred to head the Washington, D.C. FBI field office right before the Republican “insurrection” of January 6, 2021.

Bank Term Funding Program (BTFP)

The Bank Term Funding Program (BTFP) is the name for the money that the Federal Deposit and Insurance Company and the Federal Reserve loaned to banks going bankrupt, starting in March 12, 2023. A couple of more banks have been added since then, but the bulk of the money is due in March 2024. The banks don’t have the money, so they’ll have to sell what they own, US debt and mortgage backed securities. Also, the Reverse Repo market funding the federal government should be tapped out by March. With the biggest historic buyers of US debt, the Federal Reserve, Japan, and China, currently being the biggest sellers, who will buy the US debt that the banks and Treasury are selling? So, either we play another round of musical chairs, or the music stops; but, at some point, the music stops. Fun times ahead.

Cow Commodity Money

Historically, the most universally desired commodities became money, such as salt (salary), tobacco, alcohol, copper, silver, and gold. Another unusual example is the cow in ancient India and rural Mississippi during alcohol prohibition.

Spanish Bitcoin

The new president of Argentina, Javier Milei, wants to use the dollar ($) instead of the Argentine peso to escape Argentina’s high inflation. Both he and the president of El Salvador, Nayib Bukele, also want to use bitcoin with a ₿. However, it is physical bitcoin, the Spanish Dollar, that they should consider. El dólar argentífero es bitcoin fisico. The silver dollar is physical bitcoin.

Leveraging the Suez Canal and Bab al-Mandab Straight

Houthi rebels in Yemen have attacked shipping going through the Bab al-Mandab Strait between Arabia and Africa, connecting the Red Sea to the Indian Ocean. The Suez Canal then connects the Red Sea to the Mediterranean Sea, and the Israeli port city of Haifa. It is the most direct shipping route from Japan, China, and South Korea to Europe. Several shipping companies have rerouted their ships around Africa. This will increase the cost of trade between Europe and Asia and Israel and Asia. This could be used to divide the West, led by the Anglo-American Empire, from Israel and increase pressure on Israel to stop bombing Palestinians in Gaza.

Death of the Petro-Dollar II

Putin flew to Arabia and met with with delegations from the UAE and Saudi Arabia on Wednesday and the next day he flew back to Moscow to meet with delegations from Oman and Iran. All 5 nations are major energy producers. The petro-dollar is based on oil (energy) producing nations exclusively selling their oil for dollars. That appears to be ending.

SBF and CZ Get X'd

SBF and CZ have both been sued, with SBF going to prison and CZ paying massive fines. They were leaders of promoting crypto currencies through FTX and Binance, respectively. FTX is finished and Binance may be on its last legs. Will crypto survive the hype?

Osama bin Laden's Letter To America

On November 24, 2002, The Observer and The Guardian published Osama bin Laden’s letter to the American people. Yesterday, November 15, 2023, the letter went viral and The Guardian removed the document. Luckily Bryn Mawr College published the letter. The following is the text of the letter and an introduction to the text.

Turning Points II

If the three biggest buyers of US Treasury debt, the Federal Reserve, the Japanese, and the Chinese, are all selling Treasury debt, then who is buying Treasury debt? For now, it appears to be the Reverse Repo market. However, with only $1 trillion left in the Reverse Repo Market, the interest on the federal debt nearing $1 trillion annually, and $8 trillion of the $33 trillion of federal debt maturing next year, how long until the Fed has to turn around and act as the lender of last resort?

Bank Walks

Citizens Bank, out of Sac City, Iowa was about to default on November 3, so the Federal Deposit and Insurance Company (FDIC) helped the Iowa Trust & Savings Bank bail them out. That same day, depositors couldn’t deposit money into Bank of America, US Bank, Chase Bank, Wells Fargo, and Truist Bank. They, therefore, couldn’t use that money. Considering the bank bailouts earlier in the year, is the banking system walking into a bank run?

Turning Points

The Japanese Yen, the Treasury, and the Fed, are all indicating that everything is about to get more expensive in America (inflation). A turning point will come when enough people figure that out and dump their dollars for anything else. Then, we’ll have hyperinflation.

Israel vs Palestine

Supporters of Israel and Palestine have the same message to American Christians: The side that doesn't eat pork, isn't Christian, and is comprised of Semites must be financially supported or the other side that doesn't eat pork, isn't Christian, and is comprised of Semites will win.

Arbitrage

According to dictionary.com, arbitrage is “the simultaneous purchase and sale of the same securities, commodities, or foreign exchange in different markets to profit from unequal prices.” Over the past two weeks, the price of gold in Shanghai, China has been selling at ~$2,000, which is about $100 higher than the spot price at $1,900. This is not common. That means that people could be buying gold in the West and selling it in the East at a profit, moving gold to China. He who has the gold makes the rules. The world speaks English for a reason.

Canadian Politics

The Canadian Parliament, including Prime Minister Justin Trudeau, gave a standing ovation for a Ukrainian member of the Waffen SS, an elite military unit fighting for the NAZIs in World War II, while Jewish Ukrainian President Zelensky visited on Friday, September 22, 2023. Justin Trudeau and his like have been calling Candadians NAZIs for opposing the covid lockdowns. Maxime Bernier, Canadian politician and founder of the People’s Party of Canada had some pointed comments.

Mississippi Politics

Recently, Democratic nominee for the Governor of the great state of Mississippi, Brandon Presley, said that he would get rid of the good ole boys’ club. He may want to check his notes, because Democrats had run the state until a little over a decade ago. They are the good ole boys’ club.

Rich Men North of Richmond

“And they don’t think you know but I know that you do.

Because your dollar aint shit and it’s taxed to no end,

‘Cause of rich men North of Richmond.”